The house always wins. ICO launch and cryptocurrency listing.

What I want to convey is that, custody exchanges that list cryptocurrencies or new memes always have to win. Substantial amounts even.

Who stores the money? Do you or the cryptocurrency exchange?

In both cases, the money is in an account you do not control . The Kyc (Know Your Customer) identification process is similar to have access to the account. After completing it, you are created a dedicated account , and the available cryptocurrency wallet does not give you all your control, because you do not have the private key . For example, if tomorrow Binance decides to close your account, you will have the account closed. As well as if you store your cryptocurrencies on Revolut.

A person who wants to withdraw $ 1,000 from Binance will notice that the transaction will first have the status " pending " until the platform approves it. This highlights the major control that these exchanges exert on your funds.

User of cryptocurrencies or user on a platform?

A sad reality is that cryptocurrency users become, in fact, users of exchange platforms and not cryptocurrency users in the true sense of the word. Most fall into this space for speculative reasons, not to trade goods or services.

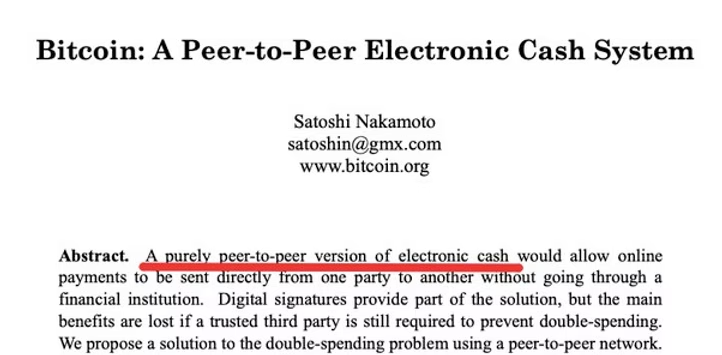

The intention of Satoshi Nakamoto, the creator Bitcoin was to create a system that was the new digital cash. That is, a means of exchange to replace the conventional system.

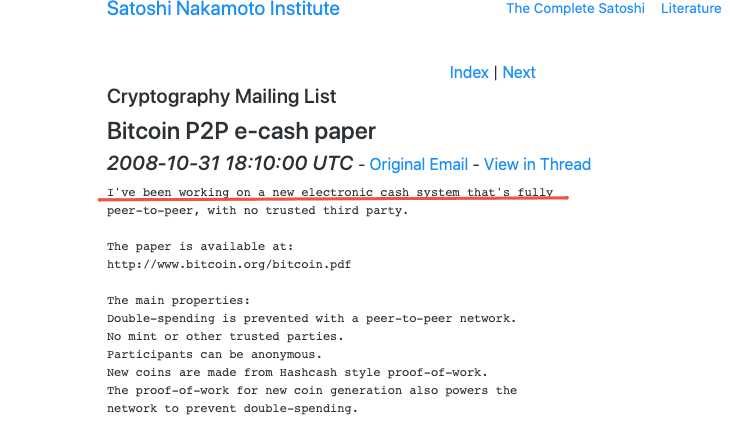

In an email he sent on 31.10.2008 he said:

So we can see that from the beginning, the Creator BTC has made this cryptocurrency to be used as a means of exchange. Things have changed, in power the custody exchanges have come to power that propose another approach, they do not say "use cryptmoners" they say "invest in cryptocurrencies" . Unfortunately, this model reduces the experience of users in the cryptocurrency industry at simple login operations and Crypto- Crypto or Crypto-Fiat conversions.

Everyone speaks of how he has invested in cryptocurrencies, it is almost impossible not to have in your group of "investors" who have invested in cryptocurrencies and who follow cryptocurrencies. Well, many of these investors have no idea what a cryptocurrency is in the true sense of the word, they did not make a cryptocurrency wallet, they did not make any real cryptocurrency transfer to purchase a service or a product. They followed graphs, "courses that teach you to be a millionaire", but I do not know in fact that that cryptocurrency has another purpose.

In the case of Bitcoin, cryptocurrency was created to replace the current financial system, also called the "digital cash". This cryptocurrency was created to replace the old financial system, not to be purchased and put in the closet until its value reaches $ 1m. Below is attached the "White Paper Bitcoin" translated into Romanian. This document is the document underlying Bitcoin and explains both his mission and the functionality that Satoshi Nakamoto gave cryptocurrency.

The impact of marketing on perception

Marketing of Exchange platforms has deeply influenced how we perceive cryptocurrencies. Today, crypto discussions are dominated by "trading", killing interest in effective use as payment methods.

It transforms cryptocurrencies into speculation tools. For example, in 2022, 65% of cryptocurrency users completely excluded their use for payments, focusing instead on fast earnings. This short -term strategy negatively affects the viability and sustainability of the long -term market.

Stagnation of innovation

Innovation is essential for the evolution of cryptocurrencies, but the monopolization of the market by several custody exchanges has led to stagnation. For example, according to a 2023 report, blockchain startups could experience a 25% decrease in funds attracted due to focus on large platforms.

Exchanges focus their resources to maximize trading and commissions, ignoring the potential of innovations. You will not find in almost a store where you can pay with bitcoin, on product websites, users do not want to trade their precious models that will enrich them. They made their account on the platform, saved the password at Exchange and is waiting for the Bull Market

Speculative culture

The dominance of custody exchanges has created an extremely speculative culture. Most users fall on these platforms in order to make a quick profit, which turns them into gambling tools. If you are looking for a newsroom that publishes news and you want to make a cryptocurrency press article, you will be in the category "Bet". On the Internet is full of guru who teaches you how to do 10x 15x as well as the gentleman below, he knows how to do 15x but he wants to be a good samaritan and helps you, the least trained ...

This mentality distorts the original values of cryptocurrencies. Start-ups and companies that develop real tools of adoption of cryptomonds are in the shadow of these colossi that have monopolized the market, have led to a deeply irresponsible behavior from which only they have to win.

Limits of interaction with blockchain

The use of custody exchanges limits the interaction of users with the block. When the funds are kept on a centralized platform, users do not benefit from transparency and immutability offered by blockchain technology.

Using an Exchange, users do not have the control they would have with a personal wallet. Users give up total control over their funds. Increasing thefts by compromising private keys, which has led to losses of $ 2.2 billion, clearly shows that 'Not Your Keys, Not Your Crypto' is not just an expression, but a harsh reality.

Below is attached the report made by TRMLABS for 2024, in which these data are obvious.

Users' rights and their protection

User protection is a vital appearance, but frequently ignored on the exchange platforms. Often, users do not benefit from additional guarantees. Some platforms claim that they have insurances that in case of need will cover all the losses, the amounts they say they can cover are huge. But in reality this will happen to this? And if so, how long?

To improve safety, it is essential to store your funds yourself, you do not have to store a platform whose addresses are well known and are always in the hacker viewfinder. You can study the article " Hackers have stolen $ 1.5 billion. Cryptocurrede robbery " which presents the latest robbery of 2025 in which USD 1.5 billion were stolen. To understand why the addresses of a custodial exchange are well known, when you submit cryptocurrency on a custodial exchange, you will receive an address on which you will receive an address to Cryptocurrencies, well so find hackers that addresses are associated with custody exchanges. And due to the fact that they are centralized entities, the funds are often centralized ...

But why if I buy bitcoin from Abarai, I don't have the same? Because if you buy bitcoin from Abarai or if you sell Bitcoin using Abarai, you are in control of your funds. Just tell us where to send cryptocurrencies or miss you where to send crypto, we do not store your money for a moment. If Tomorrow Abarai will be hated, no client will lose a lion!

Reflections on the future of cryptocurrencies

Custodian exchanges such as binance, crypto.com and coinbase have significantly affected the cryptocurrency market, turning it into a speculation environment.

In order to revive the original spirit of cryptocurrencies, a paradigm change is required. This could mean adopting non-customs solutions, promoting companies that really put their hands on a real adoption of cryptocurrencies among users and business. User education is absolutely necessary otherwise we can wake up that we do not get rid of the N-si thousands of cryptocurrencies that have overnight that make no sense, of famous coins like $ Trump or $ Melania

Serious efforts are needed to restore the true value of cryptocurrencies, that value that is found in the freedom and control they offer. It's time to go back to sincerity and rediscover what it really means to own and use cryptocurrencies! Learn what is a Wallet, what is a bitcoin wallet. Try to understand what a blockchain is,