When it comes to place your savings in assets generating income, you can choose between two popular options, namely investments in stock exchange or cryptocurrency investments. Both offer attractive, but also tailor -made risks. So which one is the most suitable for you? In this article, we will explain what each option, advantages, risks and we will make a direct comparison to help you make the most appropriate decision.

Do you think about buying or selling cryptocurrencies, but you don't know what to choose? With Abarai , you can buy cryptocurrencies using multiple payment methods, you can instantly swap between various cryptocurrencies and, most importantly, you are the only one who has full control over your funds. Abarai is the only platform in Romania that provides support in Romanian.

The main investment markets

The main investment markets are divided into several categories, each with specific features and risks:

Square market (actions):

- Here are traded the actions of public listed companies.

- Investors become co -owners of companies and can benefit from dividends and increase the value of shares.

- It is a market with high yield potential, but also with significant risks.

Bond Market:

- Bonds issued by governments, companies or other entities are traded.

- Investors borrow money to the issuers and receive interest.

- It is a market considered safer than the stock market, but with general yields.

Real estate market:

- Includes investments in residential, commercial or industrial properties.

- Can generate rental revenues and increase the value of the properties.

- Requires significant capital and is less liquid than other markets.

Square of raw materials:

- Raw materials such as gold, oil, cereals or precious metals are traded.

- Their value is influenced by global economic factors and demand and supply.

- It can be volatile and require specialized knowledge.

The cryptocurrency market:

- A relatively new market, where digital assets such as Bitcoin or Ethereum are traded.

- It is extremely volatile, with high yield potential, but also with considerable risks.

Currency Square (Forex):

- Here the currencies of different countries are traded.

- It is the most liquid market in the world, but also very volatile.

It is important to note that each market has its own risks and opportunities, and the diversification of investments is essential to manage the risk.

Investments in the stock market. Benefits and risks

Exchange investments involve the purchase of shares from public listed companies. These actions make you practically a "co -owner" of the respective company. The value of these stock exchange investments can increase or decrease depending on the company's performance and the general conditions of the economic market.

What is the scholarship and how it works?

The scholarship is a mechanism that facilitates the purchase and sale of actions, bonds and other financial instruments in an organized way. For example, the actions of a company offer you some of the property of that company, while bonds are loans issued by companies or governments. In short, the scholarship connects investors who want to buy (trading) with those who want to sell.

The benefits of an investment on the stock exchange

- Increased long -term capital . Good actions can record constant growth over the years. Although the stock market may undergo fluctuations, history shows that most investments on the stock market tend to grow over time. This means that today's investments could be much more valuable over 10, 20 or 30 years.

- Generation of passive income: Investments on stock implies the purchase of shares from public listed companies. These actions give you the right to receive annual dividends from that company.

Investments in stock exchange and associated risks

- Volatility : stock markets can be unpredictable in the short term and the value of shares can fluctuate drastically due to economic or geopolitical news. If you want to make investments on the stock market, then think in the long term and do not make impulsive decisions based on momentary emotions.

- Financial education : You need to have a minimum market understanding to make investments on the wise stock market. Education is the key. He studies, watching online courses and consults free materials available on the Abarai Academy platform.

- The lack of diversification of the portfolio can generate loss : the investment of the entire capital in a single company or industry increases the risks. If that company or industry suffers, your entire portfolio may be affected.

Cryptocurrency investments. Benefits and risks

Cryptocurrencies are active digital can be used for financial transactions, valuable reserve, utility tokens, investment tools and more. Most cryptocurrencies use blockchain technology and their security is based on complex cryptographic algorithms.

Benefits of investments in cryptocurrency

Potential for significant capital growth

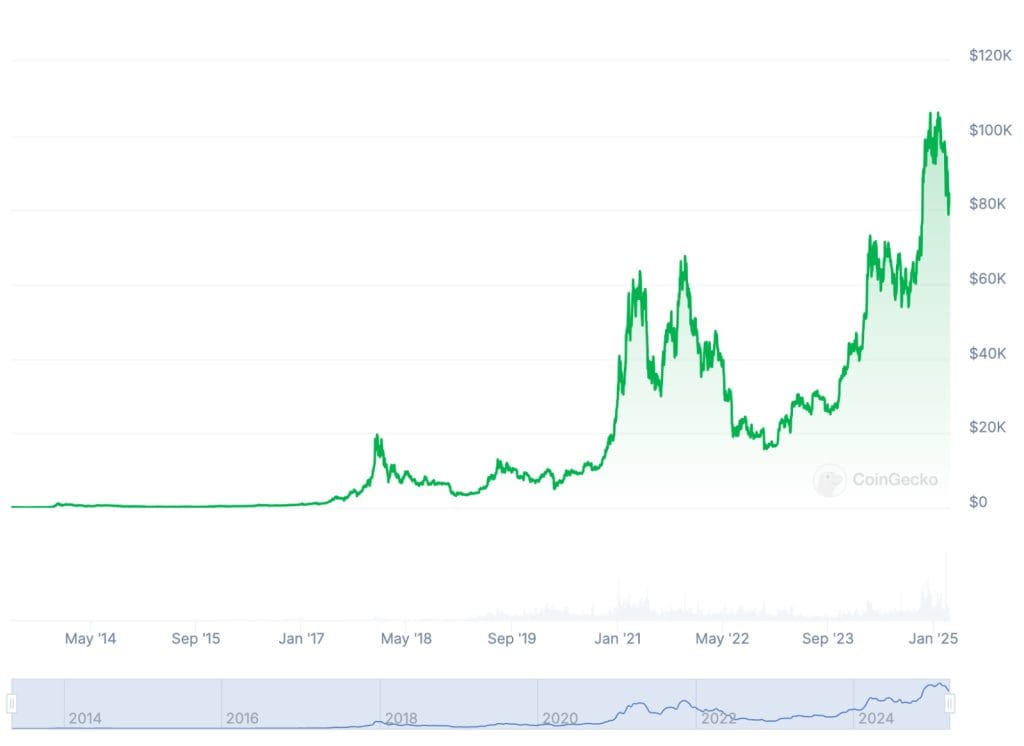

One of the most attractive characteristics of cryptocurrencies is their potential for exponential growth . In recent years, there have been lightning increases in the value of cryptocurrencies. For example, Bitcoin grew from a few cents in 2009 to tens of thousands of dollars per unit. This means that early investors have managed to get amazing earnings.

Why is it worth considering this potential?

- Market volatility can create short and long -term opportunities for investors. Although price fluctuations may seem risky, they also allow significant profits.

- The increasing adoption of cryptocurrencies by renowned financial companies and institutions (such as Tesla or Visa) increases their credibility and popularity, leading to increasing their value.

Diversification of investment portfolio

Investments in cryptocurrencies provide you with an essential diversification for your portfolio, reducing the risks associated with other assets, such as actions or real estate.

The advantages of diversification:

- Resistance to economic turbulence: cryptocurrencies work independently of traditional economies, which means they are not directly influenced by inflation, financial crises or devaluation of national currencies.

- Improved long -term portfolio performance, because including a small allocation in digital assets can have a major impact on total yield.

Access to the last -minute technology and technology

Investments in cryptocurrencies allow you to be part of a technological revolution. Blockchain technology underlying cryptocurrencies promises to transform entire industries, from banking and logistics to health and energy.

What does this technology bring?

- Total transparency and safe transactions due to blockchain technology.

- Decentralization that eliminates traditional intermediaries (such as banks).

- New economic opportunities, such as intelligent contracts used in various digital applications.

Global accessibility

Another important feature of cryptocurrencies is their global accessibility and the fact that digital assets are opened 24/7. Compared to traditional markets, such as shares, cryptocurrencies can be bought, sold or traded at any time of day and night.

How does that help you?

- Quick and accessible transactions: You can buy and sell cryptocurrencies directly from the phone or laptop, at any time of day or night, without complicated formalities.

- Lack of geographical barriers: no matter where you are, you can trade cryptocurrencies.

Potential to generate passive income

In addition to the earnings resulting from the appreciation of the price, cryptocurrencies also allow the generation of passive income, thus offering to those who want to make investments in cryptocurrency a valuable source of complementary income.

Popular options for passive income

- Staking: Some cryptocurrencies (such as Ethereum 2.0, Polkadot or Cardano) offer rewards for blocking and validating transactions.

- Yield Farming: You can use your cryptocurrencies on Defi (decentralized) platforms to get interest.

- Lending Crypto: You can borrow the cryptocurrencies of other users through safe lending platforms and earn interest.

The risks of investments in cryptocurrency

Investments in cryptocurrencies are attractive to many due to the potential for fast profit and the possibility of accessing a decentralized market. However, they come with a significant set of risks that should not be ignored.

Extreme volatility

The prices of cryptocurrencies can fluctuate dramatically in a short time, increasing significantly in a day and lowering alarmingly the next day.

For example, the price of Bitcoin had moments when it grew over $ 1,000 in a day to then lose a considerable part of value in just a few hours. Thus, on June 26, 2019, Bitcoin opened the market at about $ 11,732 closed at $ 13,976, marking an increase of over $ 2,200 in a single day. However, the next day brought a drastic decrease of $ 3,442, the price closing to $ 10,534. This type of instability can lead to considerable financial losses if investments in cryptocurrencies are not made without a well -developed strategy.

How to reduce the risk:

- Invest only amounts that you allow you to lose.

- Diversify your portfolio to reduce the impact of fluctuations.

- Avoid emotional decisions and rely on data and analysis.

Security risks

Cryptocurrencies are, by their nature, digital, which opens the way for various security risks. Hackers are constantly looking for how to exploit the vulnerabilities of cryptocurrency exchange platforms and digital wallets.

Examples of common risks:

- Losing access to digital wallet due to forgotten passwords.

- Cyber attacks on exchange platforms. In 2014, for example, Mt. Gox, a cryptocurrency exchange platform, lost Bitcoin worth $ 450 million following a cyber attack.

- Phishing or other forms of fraud, by which users are fooled to provide sensitive information.

We recommend that you read the article: "Hackers stole $ 1.5 billion. Cryptocurrency robbery"

How to reduce the risk:

- Uses a hardware or offline wallet for cryptocurrency storage.

- Activate the authentication in two steps (2Fa) for all your accounts related to cryptocurrencies.

- Avoid retaining large amounts on exchange platforms.

Lack of liquidity

Although many cryptocurrencies are widely traded, not all benefit from sufficient liquidity. Low liquidity can make it difficult to sell assets at competitive prices, especially in unstable markets.

What does this issue look like?

- Less known cryptocurrencies can have very small trading volumes, which means you may not find a buyer when you want to sell.

- Increased impact of large orders on the price, which can lead to losses.

How to reduce the risks of lack of liquidity:

- Invest in popular cryptocurrencies and high trading volume.

- Check liquidity before investing in a lesser known cryptocurrency.

- Retains a balance between long -term and short -term investments.

Why do we not recommend investments in meme coins or non -conscient virtual coins

Cryptocurrencies continue to gain popularity globally, and investors are often tempted by successful stories or hype generated by certain virtual coins. In particular, the non -conscientious coins and coins seem to be fast enrichment solutions for many. However, these investments come to the pack with significant risks that we cannot ignore.

What are the non -conscientious virtual coins and coins?

Memes Coins are cryptocurrencies created based on famous memes on the Internet or as a joke. They are promoted intensely on social networks and often become viral in a short time. Famous examples include Dogecoin and Shiba Inu.

The non -conscientious virtual currencies , on the other hand, are those new or less well -known cryptocurrencies that do not have a clear practical use, a strong community or an advanced technology.

Both categories are extremely speculative and based more on hype than in real value.

What makes them popular?

- Accessibility: Most of the time, it costs little to buy these coins, attracting investors who want to "try" the cryptocurrency market.

- The Social Media Hype: famous influences and online communities aggressively promote these coins, supplying the phenomenon of "Fear of Missing Out".

- Rapid win: Many are attracted to the idea of making major profits in a short time.

Why are investments in Meme Coinuri present a major risk?

Investments in these coins come with a multitude of significant disadvantages you need to know.

- The non -conscious coins and coins are often devoid of a concrete purpose or a useful technology. Unlike consecrated cryptocurrencies such as Bitcoin or Ethereum, they do not offer real value or long -term sustainability.

- Prices can fluctuate massively in a short period of time. A currency can increase by 1000% in a day, just to lose 90% of value the next day. This instability makes it impossible to predict long -term results.

- Many of these coins are the target of "Pump-and Dump" schemes . In such cases, a group of investors artificially increases the value of a currency, only to sell in mass, leaving other investors with significant losses.

We recommend that you read the article: "The deception with the cryptocurrency launched by Donald J Trump? $ Trump a big sting?"

Investments on stock exchange. Investments in cryptocurrency

Let us continue to analyze the differences and similarities between these two options, evaluating the key aspects for each one.

Volatility

- The stock exchange presents less fluctuations than the crypto market. However, it is influenced by macroeconomic and geopolitical factors that can cause significant short -term changes.

- Cryptocurrencies are extremely volatile. Daily fluctuations can reach even 20%-30%, which makes Crypto investments more risky in the short term.

The winning potential

- Exchange investments can generate constant gains and a long -term dividend income, but the annual growth percent is often more limited, compared to cryptocurrencies.

- Cryptocurrencies, on the other hand, have registered spectacular increases for some investors. For example, Bitcoin has increased in 10 years from a few dollars to tens of thousands of dollars.

availability

- The stock market sometimes requires more complex procedures to open a trading account, especially for beginner investors.

- Cryptocurrencies are very accessible. Platforms such as Abarai make the purchase of easy and fast cryptocurrencies, eliminating complicated bureaucratic steps.

Regulation and safety

- The scholarship is well regulated, which offers a clear safety frame for investors.

- The crypto market is constantly evolving, and the regulations gradually adapt to this dynamic. Although important steps have been taken in the direction of regulation, certain aspects may still remain unregulated in certain jurisdictions, which involves additional risks for investors. An eloquent example in this regard is the process between SEC and Ripple (XRP), which highlights the complexity of the classification of certain cryptocurrency and the potential impact of the decisions of the regulators.

Who's winning? It depends on your priorities:

- If you prefer a lower risk level, constant earnings and a regulated environment, stock exchange investments are a solid choice.

- If you have a higher risk tolerance and you want to benefit from the high winning potential, investments in cryptocurrencies may be suitable for you.

What really matters is to invest in an informed way and not allocate more capital than you can afford to lose.

ConCluSIonS

Whether you choose to invest in the stock exchange or cryptocurrency, the first step is to understand the market and make informed decisions. If you have any questions or feel ready to start, consider safe platforms like Abarai for buying cryptocurrencies or consulting a broker for stock exchange.