Tether (USDT) is the most widely used stablecoin in the world, with millions of daily active users. If you’re a cryptocurrency investor or want to better understand how stable digital assets work, this article will provide you with essential information about what this stablecoin is, how it works and why it’s important for the crypto market.

Want to buy USDT? Use the Abarai platform , one of the most popular exchanges in the country. Why choose Abarai:

- Secure and instant transactions: for amounts up to 5000 Ron you don’t need to open an account, just provide your billing details. For SWAP transactions you enjoy complete anonymity.

- You can use multiple payment methods to purchase cryptocurrencies.

- The platform offers support in Romanian, the only one of its kind in the country.

- You benefit from low and transparent fees.

What is Tether (USDT)?

USDT is a cryptocurrency known as stablecoin, which means that its value is stable and pegged to a reference asset. In the case of USDT, this asset is the US dollar, and the ratio is 1 USDT = 1 USD. The purpose of this coin was to create the “digital money of the internet,” allowing users to trade quickly in the blockchain ecosystem without the volatility of other cryptocurrencies.

Key features:

- Protects the value of your investments against market fluctuations.

- Facilitates fast transactions between cryptocurrencies and fiat currencies.

- It is available on multiple blockchains including Bitcoin, Ethereum, Tron and Solana.

Who are the founders

USDT was launched in October 2014 by Brock Pierce, Reeve Collins and Craig Sellars under the original name Realcoin. Built on the Omni Layer protocol of the Bitcoin blockchain, Realcoin was renamed Tether in November 2014.

In January 2015, USDT was integrated into Bitfinex, one of the largest crypto exchange platforms, which has contributed significantly to the growth in USDT’s use and popularity.

How it works

USDT works on the following principle:

- For each USDT unit issued, an equivalent amount of USD 1 is theoretically reserved in a bank account.

- This mechanism ensures the stability of the USDT price, meaning that it does not fluctuate like other cryptocurrencies.

Why it is unique

USDT has differentiated itself from other cryptocurrencies by its excellent characteristics of stability and versatility. Specifically:

- It is a unique digital asset due to its direct backing of US dollar equivalent reserves.

- Next to USDC, USDT has the highest trading volume among all cryptocurrencies and is used for liquidity and hedging in crypto markets.

- It can be used for both payments and quick exchanges between various cryptocurrencies.

Another important aspect is that USDT is widely accepted as a payment method and store of value within the blockchain ecosystem, which reduces the risks associated with market volatility.

How it is secured

Tether’s security is guaranteed by:

- Proof ofReserves: Tether claims that all coins issued are backed 100% by valuable assets. These reserves include fiat money, government securities, gold and other safe investments.

- Multiple blockchains: USDT is issued on multiple networks, protected by the consensus mechanisms of these blockchains, such as Proof-of-Work (Bitcoin) or Proof-of-Stake (Ethereum, Tron). The security of these blockchains contributes to the security of USDT transfers.

- Periodic auditing: Even though there have been controversies around transparency, Tether regularly works with several auditing firms to provide attestations on its reserves.

- Cold storage: Exchanges and financial institutions that handle large amounts of USDT often use offline storage to protect funds from online attacks.

How many USDT coins are in circulation

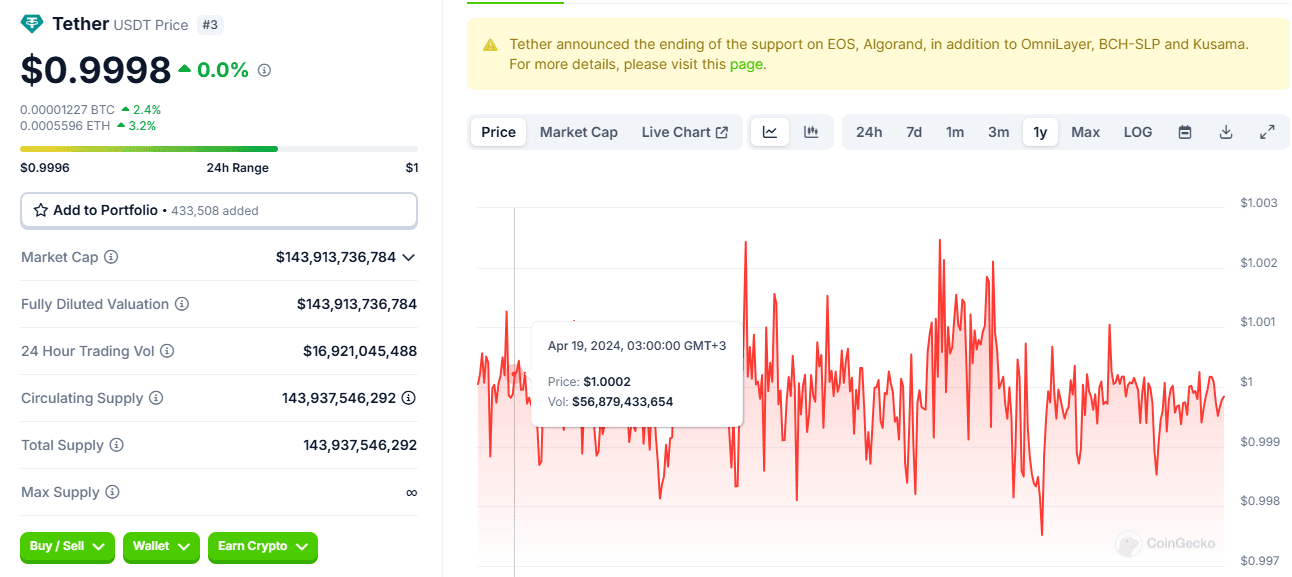

There are currently 143,937,546,292 USDT in circulation, according to CoinGeko.

Tether (USDT): Price History

Since its launch in 2014, USDT has gone through multiple transformations and controversies. Below, we present the history and evolution of the USDT price over various key periods, highlighting the major developments as well as the challenges encountered.

2015 – 1026 Start period

USDT became part of the crypto ecosystem in 2015, when the Bitfinex platform decided to integrate it into its operations. During this period, USDT remained stable with a constant ratio of 1 USD, thanks to the backup collateral provided.

However, the use of USDT has been limited, with most traders hesitant to widely adopt a stablecoin in the absence of clear regulation attesting to the promised reserve.

Key milestones:

- Introduction of USDT on the bitcoin blockchain (Omni protocol)

2017 – 2018: Accelerated growth. First controversies emerge

Since 2017, the demand for USDT has grown exponentially, influenced by the rising popularity of the crypto market. The value of the USDT market grew from a few million to over USD 2.8 billion by the end of 2018.

However, this period of rapid growth has not been without its scandals. In 2018, Tether was accused of a lack of transparency about its reserves and market manipulation.

Key milestones:

- USDT-dominated transactions accounted for up to 80% of bitcoin’s trading volume in some months of 2018.

- In October 2018, a moment of uncertainty caused USDT to temporarily fall below the USD 1 ratio. This incident triggered further questions about Tether’s credibility.

2019 – 2023: Dominance and resilience

Over this period, USDT has cemented its position as a key player in the cryptocurrency industry. A key turning point was in 2019, when USDT’s trading volume surpassed even Bitcoin’s, making it the core asset for most exchange platforms.

Despite controversies and legal investigations, including fines from the CFTC for false reserve misrepresentations, Tether has endured and maintained its position as the leading stablecoin on the market.

Key milestones:

- Creation of USDT on popular blockchains such as Ethereum, Tron and Binance Smart Chain.

- Launching the renewable energy-based bitcoin mining initiative in Uruguay in 2023.

- Working with authorities to help combat billions of USDT in illicit activities.

2024 – Present: Diversification and consolidation

Today, USDT continues to set new standards for stablecoins. With record profits of $5.2 billion in the first half of 2024, the company has diversified its operations, launching divisions dedicated to bitcoin mining, artificial intelligence and blockchain education.

Key milestones:

- Major investments in innovative technologies such as brain-computer interfaces.

- Plans to launch a new stablecoin linked to AED indicate Tether’s growing interest to diversify and explore new markets.

- Expanding government involvement through strategic collaborations in countries such as Georgia and Switzerland.

USDT vs. USDC: Which is the better stablecoin for you?

What is USDC?

Launched in 2018 by giants Circle and Coinbase, USDC was created to offer a safer and more regulated alternative to its market competitors. Each USDC is backed 1:1 by US dollars or their equivalent cash assets.

USDC Features:

- Regulatory and transparent: USDC reserves are audited monthly by independent firms.

- MiCA (Markets in Crypto-Assets) compliance: USDC complies with the regulatory standards imposed by the European Union.

- Global Accessibility: Available on major platforms and multiple blockchains, including Ethereum and Solana.

Circle has relied on transparency from the start to gain investor trust. All reserves are backed exclusively by dollars and Treasuries and offer a high degree of safety.

Differences between USDT and USDC

Transparency and regulation

- USDT: Criticized in the past for lack of a full reserves audit, raised questions among investors.

- USDC: Monthly audits carried out by Grant Thornton LLP, providing investors with added certainty and clarity.

Use in Transactions

- USDT: Most popular for quick and cheap trades in emerging markets.

- USDC: Preferred in regulated markets due to high compliance with financial standards.

Volume and Acceptance

- USDT: Has the highest trading volume and liquidity.

- USDC: Although not as widespread as USDT, it is rapidly growing in popularity due to user trust.

Stability

Both currencies are designed to maintain a parity of $1. However, in March 2023, USDC suffered a significant deviation from parity, falling to $0.90 amid Silicon Valley Bank’s financial difficulties. Despite this event, USDC quickly returned to par value.

Which to choose: USDT or USDC

Choose USDT if:

- You prioritize increased volume and liquidity.

- You need fast trading, especially on platforms with extensive Tether support.

Choose USDC if:

- You seek maximum transparency and safety.

- You comply with strict regulations in the European Union markets.

Both USDT and USDC are essential stablecoins in the crypto world, each with strengths and limitations. The right choice depends on your specific needs, the level of risk you want to take and your goals as an investor.

Main differences between Tether (USDT) and other cryptocurrencies

Understanding the differences between Tether (USDT) and other cryptocurrencies is important for anyone looking to get into the crypto market. Here are some key points an investor should consider:

Price stability

- USDT is designed to have a stable price (around $1.) This provides certainty for users who want to avoid the volatility of the crypto market.

- Other cryptocurrencies, such as Bitcoin or Ethereum, are highly volatile and can fluctuate massively in a short period of time, which means a higher risk for investors.

Main use

- USDT is mainly used as a store of value or for quick transactions between other cryptocurrencies. For example, many users convert Bitcoin or Ethereum into USDT to protect their gains from market fluctuations.

- Cryptocurrencies like Bitcoin are considered more of a long-term store of value, much like digital gold.

- Other cryptocurrencies such as Ethereum, on the other hand, are known for their capabilities to facilitate the running ofsmartcontracts and decentralized applications, rather than being focused on stability.

Volatility vs. low risk

- With USDT, the risk of large losses due to fluctuations is minimized, making it very attractive to early stage investors.

- Investments in other cryptocurrencies, on the other hand, can offer big gains but carry considerable risk.

Benefits and limitations of using USDT

Benefits of using USDT

Outstanding stability

- Unlike Bitcoin, the value of USDT is not affected by market news or future regulations.

- It allows traders to preserve their capital without major risks.

Fast transactions and low costs

- Many users use USDT to make fast money transfers, especially in markets where traditional transactions would involve high fees.

Available on multiple platforms

- Because USDT runs on multiple blockchains (Ethereum, Tron, Binance Smart Chain, etc.), it is accessible to users around the world.

Useful trading tool

- Traders use USDT to “freeze” gains without completely withdrawing them from the crypto ecosystem. For example, if the price of a crypto asset drops sharply, they can switch that asset to USDT to protect their investment.

Limitations of using USDT

As appealing as it may be, any financial asset comes with risks. What’s important to know about the limitations of USDT:

Questions about the legitimacy of USDT reserves

Over the years, Tether has been criticized for a lack of transparency about its financial reserves. Although the company states that each USDT is backed 1:1 by dollars or other reserves, there have been controversies that have raised questions.

The Commodity Futures Trading Commission (CFTC) accused Tether in October 2021 of making false or misleading statements about the reserves backing the USDT stablecoin. Specifically, the CFTC found that Tether falsely claimed that each USDT is backed 1:1 by U.S. dollars, while in reality its reserves were not always fully backed by cash. In October 2021, the CFTC reached a settlement with Tether, which included the payment of a $41 million civil fine and a requirement that Tether cease and desist from any further violations of the Commodity Exchange Act (CEA) and CFTC regulations.

Risk of loss of funds on USDT transfer

Because USDT is issued on different blockchains, users need to be careful which network they choose. Sending USDT on the wrong network may result in loss of funds.

Unclear regulations

The cryptocurrency market is still being regulated in many countries. Thus, changing regulations could affect how USDT is used.

Why use Tether (USDT) if you’re an investor

Investors choose Tether because of its unique benefits. If you’re wondering why USDT would suit your strategy, here are a few arguments:

Protection against volatility

The cryptocurrency market is notorious for rapid and unpredictable price fluctuations. Tether provides a safe loophole at these times. For example, if Bitcoin suddenly drops in value, investors can exchange their funds into USDT to protect their capital.

Perfect for global trading

Ever tried sending money internationally through banks? The process can be slow and costly. Instead, with USDT, you can make transactions in minutes, with minimal or in some cases no fees.

Easy to integrate into varied portfolios

Experienced investors use stablecoins such as USDT to diversify portfolios without taking additional risk. Also, for certain trading strategies, USDT serves as a solid base to buy or sell other cryptocurrencies.

How to start using USDT

Getting started using USDT is simple, especially if you follow these steps:

- Choose a digital wallet – You need a USDT-compatible wallet. Some of the most popular options are Trust Wallet, MetaMask or hardware wallets like Ledger.

- Buy Tether (USDT )- You can purchase USDT using the Abarai platform, simply and quickly, taking advantage of favorable exchange rates and support in English.

USDT and the future of stablecoins

As cryptocurrency adoption continues to grow around the world, stablecoins like USDT are becoming increasingly relevant. They serve as a bridge between traditional finance and the crypto world, offering a balance between stability and innovation. For investors looking for fast, secure and stable solutions, USDT continues to be a popular option. However, it is essential to stay informed and make conscious choices before investing.

If you’re interested in getting started with Tether or other cryptocurrencies but have questions, we’re here to help. Deepen your knowledge about crypto investing and discover valuable resources on the Abarai blog. Editor’s Choice: