In the context of the cryptocurrency market, Bitcoin dominance is a key indicator that reflects the share of Bitcoin’s market capitalization in the total capitalization of all cryptocurrencies. If you are an investor, understanding this indicator can give you a significant advantage in making the right decisions. In this article, we reveal everything you need to know about Btc dominance: what it is, what influences it and, most importantly, how it can affect your investment portfolio.

Buy or sell Bitcoin instantly in Romania through the Abarai platform. Using Abarai you can trade Bitcoin or other cryptocurrencies, you can sell or swap, all in one platform.

- Abarai offers you the possibility to make secure and fast transactions: You don’t need to make an account for transactions less than 5000 Ron (you just need to provide your billing details)

- Abarai is the only platform that offers support in Romanian.

What is Bitcoin dominance

Bitcoin dominance represents the percentage of Bitcoin’s market capitalization compared to the entire cryptocurrency market capitalization. Basically, it shows how much Bitcoin “dominates” the crypto market relative to all other cryptocurrencies. Values can range between 0% (Bitcoin has no influence) and 100% (the entire market is represented by Bitcoin). For example, if Bitcoin’s market capitalization is $50 million out of a total cryptocurrency market capitalization of $100 million, Bitcoin’s dominance would be 50%. Bitcoin dominance is a key indicator, used by investors to analyze crypto market dynamics and estimate the performance of other currencies against Bitcoin.

Why Btc dominance is important to understand

Understanding and correctly using Bitcoin dominance will help investors identify profitable opportunities and minimize risks. Fluctuations in this metric can reveal market trends and show the right time to invest in either Bitcoin or other cryptocurrencies.

Btc dominance and its benefits for investors

- Understanding the current market phase: By analyzing Btc dominance, you can identify whether the market is growing, stagnant or declining. This can help you in making informed investment decisions.

- Identifying altcoin season: When Btc dominance drops significantly, it’s a strong indication that altcoins are becoming more popular. For investors, this may be the ideal time to explore other currencies.

- Market trend reversal predictions: One of the most valuable aspects of Btc dominance analysis is the ability to identify potential market trend reversals, or so-called ‘U-Turn’ patterns.

- Understanding phases of Bitcoin price consolidation: Bitcoin’s increased dominance during cryptocurrency market declines may indicate a period where the Bitcoin price is stabilizing.

Understanding the current market phase

When Bitcoin dominance increases

When Bitcoin’s dominance increases, its market capitalization grows faster than that of other cryptocurrencies. Overall:

- Bitcoin “dominates” the market. Investors prefer to choose it over othercoins for extra safety.

- Increases in dominance are common in bear (bear) markets when investors sell riskier coins and prefer to hold bitcoin.

- BItcoin dominance can also increase in bull markets when Bitcoin outperforms other cryptocurrencies.

When Bitcoin dominance decreases

When Bitcoin’s dominance declines, the phenomenon is often associated with “Altcoin Season” (Altcoin Season). Altcoin prices rise rapidly, and Bitcoin loses market share. These periods are often short but extremely profitable for investors. In such situations, investors must capitalize on these opportunities quickly, as the “altcoin season” does not last long.

Bitcoin dominance and identifying the altcoin season

The altcoin season is a period when alternative cryptocurrencies (ETH, ADA, BNB, etc.) rapidly increase in value and Bitcoin’s dominance declines. This often happens in bullish markets, when investors are willing to risk more for bigger gains.

Indicators of a possible altcoin season include:

- Bitcoin’s steady decline in dominance.

- High demand for a number of well-priced cryptocurrencies.

- General increase in cryptocurrency market capitalization.

It is important to note that altcoins tend to perform well for short periods. So timing is key to maximizing gains.

Bitcoin dominance and reversing market trends

A crucial aspect of this metric is its ability to predict so-called “U-Turn” (reversal of market trends) patterns. At times, the market can go from a bullish (uptrend) to a bearish (downtrend), and analyzing Btc dominance can help predict these changes.

Example:

If you see that Bitcoin’s dominance starts to gradually increase in a generally bearish context, this is an indication that BTC is once again capturing market confidence. This could be a good time to invest before prices rise.

Understanding the Bitcoin price consolidation phase

Another important use of bitcoin’s dominance is in understanding price consolidation phases. Generally, in bearish periods, Bitcoin tends to maintain its leading position, which implies a price consolidation.

This consolidation phase may indicate that the market is preparing for a rally. Investors following this trend may thus be able to profit from any rapid increases in the price of BTC.

Tips for investors:

- If Btc dominance is on the rise in a stagnant market, this may be a good signal to move funds from altcoins into BTC.

- Monitor the Btc dominance charts available on platforms like TradingView to identify these key moments.

How Bitcoin dominance is calculated

Bitcoin dominance is expressed as a percentage and can be tracked online on various platforms (e.g. TradingView), but you can also calculate it yourself using a simple formula:

BTC market capitalization / Total crypto market capitalization = Bitcoin Dominance Index

Example:

- Bitcoin’s market capitalization is $50 million.

- The total crypto market capitalization is $100 million.

Calculation: $50 million ÷ $100 million = 50% Bitcoin dominance.

Thus, this value gives a quick overview of where Bitcoin stands in relation to the entire market.

How to track Bitcoin dominance

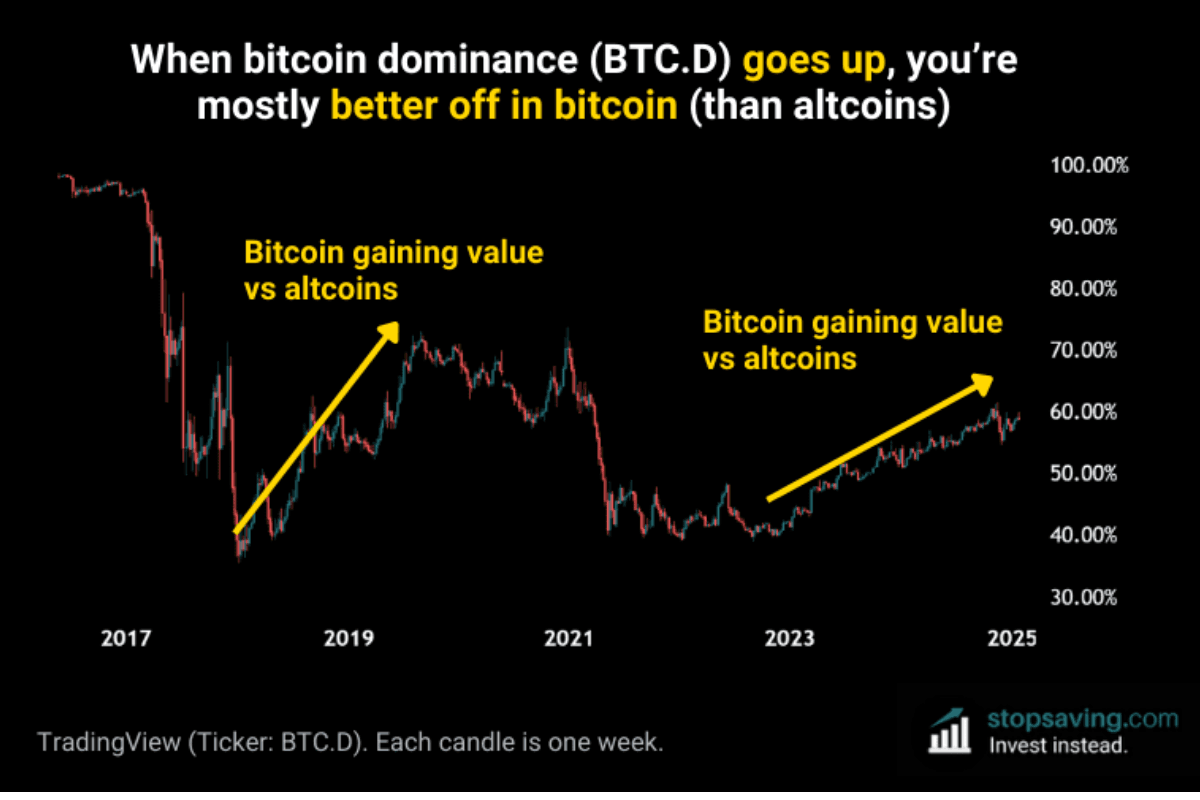

You can view the Bitcoin dominance chart on platforms like TradingView by searching for the symbol BTC.D (BTC Market Capitalization Dominance). This chart can become a useful tool to understand the overall sentiment of the crypto market and tailor your investment strategies.

Top 7 factors affecting Btc dominance

Next, we will detail the main factors influencing Btc dominance, analyzing how they contribute to the fluctuations observed in Bitcoin’s market share. We explore the impact of market sentiment, the influence of global regulation, the dynamics of altcoin development, crypto market cycles, institutional adoption, macroeconomic factors, and technological advances, each of these factors playing a crucial role in determining Bitcoin dominance and the overall evolution of the cryptocurrency market

Market sentiment and news

News and perceptions of the global community play a major role in determining Btc dominance. In periods when there are positive announcements, such as institutional adoption (e.g. Tesla or MicroStrategy acquiring Bitcoin) or technological innovations (e.g. Lightning Network), Btc dominance tends to increase.

On the other hand, negative news, such as strict regulations in certain countries, security scandals or extreme volatility, can negatively influence this indicator, paving the way for altcoins.

Recent examples

- Positive news: announcements about bitcoin ETFs adopted in regulated markets.

- Negative news: China’s mining ban in 2021, which caused a temporary decline in BTC dominance.

Rising popularity of other cryptocurrencies

The growing popularity of altcoins such as Ethereum (ETH), Cardano (ADA) or Solana (SOL) may significantly affect Bitcoin’s dominance. These cryptocurrencies attract investors through their specific utility, redistributing capital to other crypto projects.

Factors contributing to the rising popularity of altcoins:

- The launch of new techtechs, such as DeFi and NFTs, which bring increased visibility to altcoins.

- The creation of strong new communities supporting their development and adoption.

Institutional adoption

The entry of institutional players into the Bitcoin market has a huge impact on BTC dominance. Large investors, such as mutual funds, investment banks or Fortune 500 companies, influence the price of Bitcoin due to the massive volumes traded.

Major acquisitions by companies such as MicroStrategy or Square have led to a massive increase in the perception of Bitcoin as “digital gold”, resulting in the rise of Btc’s dominance in the cryptocurrency market.

Macroeconomic factors

Global economic conditions, such as inflation rates, geopolitical instability and interest rate decisions, play a significant role in the dynamics of the cryptocurrency market, strongly influencing Bitcoin’sdominance.

- In times of economic instability, Bitcoin is often perceived as a “safe haven”, which can increase interest in BTC.

- Conversely, stable economic conditions or rising interest rates may cause investors to seek other assets, diminishing BTC’s dominance.

Technological advances

Technologies that improve the scalability and security of the Bitcoin network are having a key impact on its dominance. For example, the secondary deployment of solutions such as the Lightning Network, aimed at speeding up transactions and reducing fees, has increased the attractiveness of BTC.

Ongoing developments:

- Segregated Witness (SegWit) enables smaller blocks and more efficient data transfer.

- Taproot Upgrade adds more privacy and efficiency for smart contracts.

As adoption of these advances becomes more widespread, Bitcoin becomes more competitive and Btc dominance grows.

Emotions, investor perception and government regulation

Last but not least, investor emotions and perceptions significantly influence Bitcoin dominance. For example:

- During “bull market” periods, Bitcoin attracts massive capital inflows, resulting in Btc’s dominance increasing.

- In “bear market” periods, investors tend to shift to speculative altcoins or temporarily exit the market, consequently Btc dominance may decrease considerably.

Countries that adopt clear and favorable policies, such as El Salvador, increase confidence in Bitcoin, which translates into higher Bitcoin dominance. Conversely, new bans or strict taxes on cryptocurrencies, such as in China or India, may diminish the attractiveness of Btc.

Example: US and SEC (Security and Exchange Commission) regulations on Bitcoin may significantly alter perceptions in global markets.

How Btc dominance affects the price of altcoins

One of the most important dynamics that any investor should understand is the relationship between Bitcoin dominance and the performance of altcoins. We will further analyze how Bitcoin dominance influences altcoins and provide some essential tips for anyone looking to invest in Bitcoin or altcoins.

In general, the prices of altcoins tend to follow Bitcoin price movements. When Bitcoin rises, many altcoins follow the same trend, and when Bitcoin falls, altcoins tend to fall even more. Another key moment is Bitcoin’s period of consolidation, when its price does not experience major fluctuations and the crypto market is calm:

- During these periods, altcoins may experience small increases or a temporary surge in interest.

- It is important, however, to monitor for any sudden increase in BTC’s dominance, which may signal a return of investors exclusively to Bitcoin.

Beware, a massive increase in BTC dominance can cause a real “straw fire” in the altcoin market. During these times:

- Interest in altcoins drops dramatically.

- Trading volumes for altcoins shrink.

- Prices of altcoins can fall rapidly, affecting the portfolios of unprepared investors.

Table: How Bitcoin (BTC.D) Dominance and Bitcoin Prices Influence Altcoin Prices

| Bitcoin Dominance (BTC.D) | Bitcoin Price (USD) | Altcoin Prices (USD) |

|---|---|---|

| Increasing | Rising | Falling or rising less than Bitcoin |

| Rising | Declining | Falling more than Bitcoin |

| Stable | Declining | Declining |

| Declining | Rising | Rising more than Bitcoin |

| Falling | Stable | Stable or falling less than Bitcoin |

| Stable | Rising | Increasing |

Investor tips and final conclusions

If you are an investor and still learning about Btc dominance and the cryptocurrency market, here are some useful tips that will help you protect your portfolio:

Monitor BTC dominance and bitcoin price

Closely monitor not only the Bitcoin price, but also Btc dominance. This information can help you anticipate future trends and help you build a profitable investment strategy.

Diversify your portfolio

In stable times, consider diversifying your investments. A diversified portfolio could include bitcoin, established cryptocurrencies such as ETH, SOL or ALGO and possibly stablecoins.

Don’t make impulsive decisions

The cryptocurrency market is volatile. Avoid buying or selling based on panic or hype without careful analysis.

Use the Abarai platform

The Abarai platform allows users to buy bitcoin and other cryptocurrencies while providing valuable informative materials that explain how the crypto market works.

In conclusion, Bitcoin dominance will continue to be a major factor influencing the cryptocurrency market. For investors, this index remains an essential indicator for understanding the dynamics of the cryptocurrency market, reflecting both Bitcoin’s position as a dominant asset, as well as general market sentiment, movement of capital flows and potential trend changes.

If you want to learn more about cryptocurrencies, you can find a series of articles and educational materials on the Abarai blog. We recommend you read: