The world of cryptocurrencies and blockchain technology is opening new horizons for investors, and staking is emerging as one of the easiest and most profitable ways to generate passive income from crypto. In this article, we’ll explain everything you need to know about crypto staking: what it is, how you can get started with simple steps, and what benefits it brings in the long run. Whether you’re a beginner or an experienced crypto investor, this comprehensive guide will reveal how to turn staking into a profitable and effective strategy.

Staking crypto: A smart way to generate passive income

In layman’s terms, crypto staking is the process by which you buy, deposit and lock a certain amount of cryptocurrency into a digital wallet or platform to support the running of a blockchain. In return, you receive rewards in the form of additional cryptocurrencies. It’s a method by which you can earn passive crypto income based on the cryptocurrencies you already own.

What you need to know:

1. Blocked cryptocurrencies become active validation nodes in the network.

2. When you do crypto staking of cryptocurrencies, you support the blockchain network and get rewards.

3. Staking is an activity that only happens on proof-of-stake (PoS) blockchains.

How does Proof of Stake (PoS) work?

It is much more energy efficient.

It allows faster transactions and lower fees.

Participation is more affordable for users.

Benefits of crypto staking

Staking comes bundled with a number of benefits that make it attractive to investors, such as:

By staking crypto you generate passive income: You earn regular rewards just by owning and “locking” your cryptocurrencies.

You actively participate in the security of the network: By staking, you help the blockchain become more secure and perform better.

You have a say: Those who own coins and choose to staking can vote and influence key decisions of the network.

Crypto staking risks

Like any other investment, staking involves a number of risks.It’s important to know them before you start, so here are some of the most important:

Lock-up Periods: In fixed staking, your funds will be locked up for a certain period of time, during which you cannot access them. If there are dramatic price drops in the market during this time, you will not be able to liquidate your deposits and your capital will suffer. With flexible staking you can liquidate your deposits, but the rewards are generally much smaller.

Slashing: Blockchain networks are strict: if validators violate the rules of the network or don’tperform their tasks properly, they are penalized. This means that any technical problems or validator outages could affect your staking gains.

The danger of a cyber attack: Any major security incident could result in the loss of your tokens. This danger can be eliminated by “cold stacking”, i.e. storing the coins on hardware without an internet connection.

Choosing an insecure staking platform: Staking on an insecure or unauthorized platform can lead to financial losses.

How do you choose a crypto staking platform?

When choosing a crypto staking platform, consider the following criteria:

1. Reputation and security – The platform must be recognized for safe practices.

2. Rewards – Winning rates vary from platform to platform, so check the returns offered.

3. Flexibility – Some platforms allow staking without lock-in periods, but with lower rewards.

4. Support for your desired cryptocurrencies – Make sure the platform supports the currency you want to use for staking.

Step-by-step guide to start staking

If you’re ready to start staking, here’s how to do it in five simple steps:

1. Choose a cryptocurrency – Opt for PoS-compatible coins such as Ethereum, Cardano or Solana.

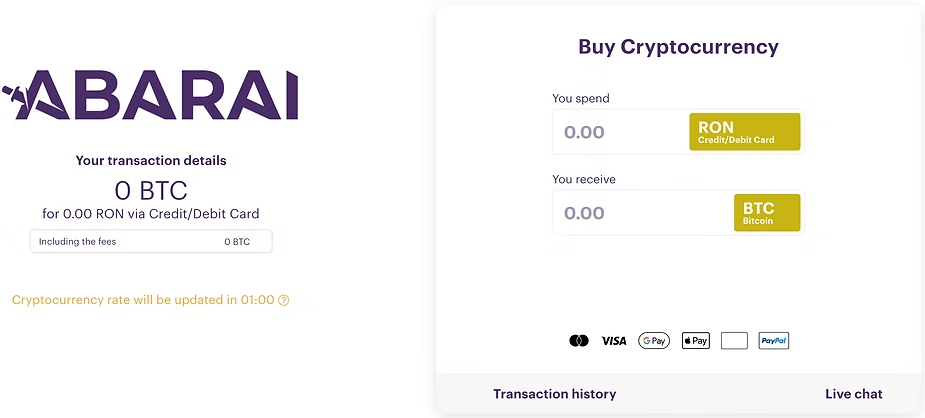

2. Buy the coin – If you don’t already have the assets, buy them from trusted platforms, such as the Abarai platform.

3. Select a staking platform – Choose a platform with good reputation and attractive returns.

4. Move your coins to a wallet – Transfer your assets to a crypto wallet supported by the platform.

5. Start staking – Follow the platform’s instructions to lock your coins and start earning rewards.

What are the most popular cryptocurrencies for staking?

Here are some of the most popular cryptocurrencies:

Ethereum (ETH): After moving to PoS, Ethereum is becoming one of the most sought-after coins.

Cardano (ADA): A sustainable blockchain with competitive rewards.

Solana (SOL): Renowned for transaction speed and low fees.

Polkadot (DOT): Ideal for those looking for higher rewards.

Tezos (XTZ): Perfect for beginners with its simple staking process.

Advanced staking strategies

Once you understand the basics, you can try more advanced strategies to optimize your winnings:

Reinvesting rewards – Use the rewards earned to buy more cryptocurrencies and continue staking (compounding).

Diversification – Staking on multiple blockchains reduces risk and increases earning potential.

Is staking right for you?

Staking can be an excellent crypto passive income opportunity if you understand the risks. It’s ideal for investors who can afford to lock up some of their funds for a longer period of time and want to contribute to improving blockchain ecosystems. One of the most popular cryptocurrencies for staking is ETH, so let’s further analyze this cryptocurrency. We will present a brief history of Ethereum price, the main events that have influenced the price of this cryptocurrency over time but also why ETH is suitable for staking.

Ethereum price, history and evolution

Launched in 2015 by Vitalik Buterin and his team, Ethereum quickly stood out for its unique utility. Unlike other cryptocurrencies like bitcoin, Ethereum is not just a “store of value”, it’s a platform that supports smart contracts and a host of decentralized applications.

Ethereum price history:

2015: Initial launch set a price of around $0.30 per ETH.

2018 – 2020: The cryptocurrency is experiencing explosive growth .In January 2018 we have an Ethereum price of around 1,400 USD. Subsequently, as with many other cryptocurrencies, the price experienced a massive correction, hovering between 100-400 USD.

2021: During the NFT and DeFi boom a new price record is reached, with Ethereum reaching up to USD 4,800.

Current Ethereum price trends

After reaching all-time highs in 2021, Ethereum, like the rest of the crypto market, felt the impact of a bear market. Between 2022 and 2023, the price gravitated between USD 1,000 and USD 2,400, influenced by global economic uncertainty and government regulations, before rising again to USD 4,000 starting in 2024.

Events influencing the price of Ethereum

The Merge (2022): the switch from PoW to PoS reduced Ethereum’s network power consumption by 99%. This upgrade attracted investors concerned about sustainability.

DeFi and NFTs: The DeFi platforms (Uniswap, Aave) and the NFT boom (OpenSea) continue to generate intense traffic and usage on the Ethereum blockchain.

Institutional adoption: more and more financial institutions are considering using Ethereum for tokenization or stablecoins.

Ethereum price, long-term evolution

In the long term, the value of Ethereum is expected to increase significantly, both due to technological development and favorable adoption potential:

Improved scalability: Planned upgrades, such as Sharding, will allow the network to handle more simultaneous transactions, thus reducing fees.

Global adoption: Ethereum will continue to be the platform of choice for companies looking to develop applications in Web3.

Web3 and Metavers: Ethereum’s role in building the decentralized internet is vital.

Interested in learning more about Ethereum? Then we recommend you read our article: Ethereum, Bitcoin’s little brother.

Why Ethereum is an excellent choice for crypto staking

With the move to Proof-of-Stake (PoS) in September 2022, Ethereum offers a new opportunity for investors: staking ETH, a way to earn passive crypto income by participating in securitizing the network.

Benefits of Ethereum staking

Ethereum staking comes with a lot of advantages that appeal to both experienced investors and those new to the cryptocurrency world.

1. Get attractive passive income

By staking, you can earn rewards in ETH on a constant basis without having to actively trade. Basically, you put your coins to work. Interest rates vary but are competitive with other ways to earn in the financial sector.

2. Help improve the security of the Ethereum network

By staking, you help keep the Ethereum network secure and functional. Your coins are used to validate transactions and create new blocks.

3. Reduce negative ecological impact on the environment

Ethereum PoS consumes 99.95% less energy than the previous PoW model. By choosing staking, you adopt an environmentally friendly approach.

Beware of risks:

✔ When staking your ETH, your funds are locked in for a certain period. Depending on the platform you choose, instant access to funds may be limited.

✔ When you use a third-party service for staking, there are operational risks such as cyber-attacks or fraud. That’s why it’s essential to choose trusted platforms.

✔ The price of ETH can vary significantly over a period of time. Although you get rewards, volatility can affect the overall value of your portfolio.

Top cryptocurrencies for staking (source: stackingrewards.com)

Cryptocurrency | Annual staking rate (%) | Major benefits |

Ethereum | ~3.33% | Maturity, vast ecosystem |

Theter | ~10% | High security |

Solana | ~9.7% | Low fees, high speed |

Polkadot | ~11.8% | High rewards but high complexity |

Near Protocol | 9.41% | High rewards |

Ethereum is often preferred because it offers stability and security in an already highly developed ecosystem.

How to do crypto staking using Ethereum

1. Prepare your crypto wallet

The first step is to have a digital wallet that supports Ethereum and staking. Popular examples include Ledger, Trezor or MetaMask.

2. Decide the staking method

There are two main ways of staking on Ethereum:

Staking directly – Requires a minimum of 32 ETH and managing a validation node. It is the preferred method for advanced users.

Staking through platforms/pools – A more affordable solution for those with less than 32 ETH. Platforms such as Binance, Coinbase or Lido Finance allow staking with smaller amounts.

3. Select a trusted platform

The popularity of Ethereum has led to the emergence of many staking platforms. Look for a platform with a solid reputation, reasonable fees and transparency in the rewards offered.

4. Activate staking and track your winnings

Once your ETH is staked, start tracking your rewards. Most platforms offer real-time tracking functionality.

Is Ethereum a good choice for staking rypto?

Other forms of crypto passive income

1. Lending (Crypto Lending)

Popular platforms: Aave, Compound, BlockFi.

Benefits: Constant interest without actually selling the coins.

How it works: Deposit crypto into a smart contract, and the platform manages the loans.

2. Yield Farming

Benefits: High rewards, but there can be higher risks.

How it works: Connects the digital wallet to a DeFi protocol, provides liquidity and collects rewards.

3. Masternodes

Example: DASH, PIVX.

Benefits: Frequent rewards and high security.

How it works: You need to hold a minimum number of coins specific to that network and set up a dedicated server.