Bitcoin dominance shows how big Bitcoin is compared to all other cryptocurrencies. It’s like having a big cake (all the cryptocurrencies), and Bitcoin dominance tells you how big a slice of the cake belongs to Bitcoin. If Bitcoin has a big slice, it means that a lot of money is invested in Bitcoin compared to the other cryptocurrencies.

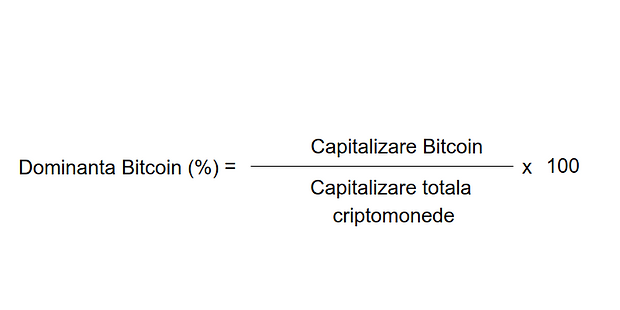

How is bitcoin dominance (btc) calculated?

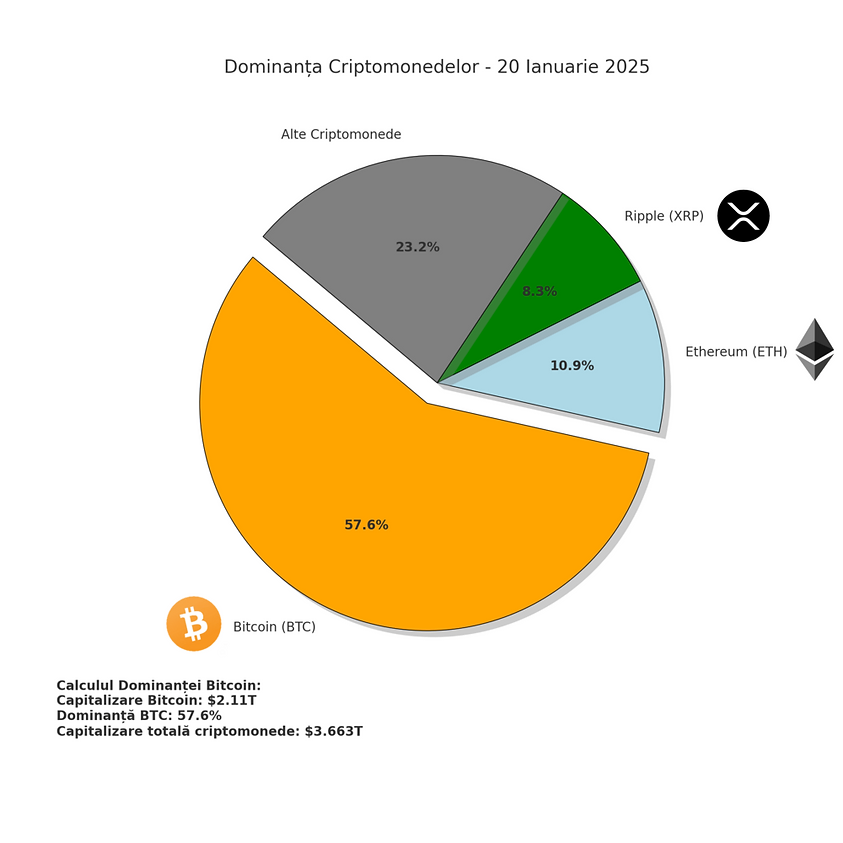

If we were to take an example from January 20, 2025 where Bitcoin had a capitalization of about 2.11 trillion dollars (USD), we can determine bitcoin dominance using the formula:

In this case we can transpose the above image with the new data and have a clear picture of the dominance picture on January 20, 2025

The importance of bitcoin dominance in the cryptocurrency market

The dominance of bitcoin (btc) in the cryptocurrency market is very important and can be understood in several ways. This report shows how strong and dominant bitcoin is compared to other cryptocurrencies and gives clues about market trends. If Bitcoin dominance is high, it means that Bitcoin is the strongest cryptocurrency in the market.

Bitcoin dominance is one of the most important indicators to understand whether the market is in a bull market or a bear market. This helps investors and traders to better understand the cycles and create appropriate strategies.

In bull periods: other cryptocurrencies (altcoins) usually grow faster than Bitcoin, and Bitcoin’s dominance decreases.

In bear periods: Bitcoin’s dominance increases as people prefer Bitcoin, considering it safer.

This parameter helps investors to see in which direction the market is going and make better decisions.

WARNING: IF BITCOIN DOMINANCE IS ABOVE 50% IT DOES NOT NECESSARILY MEAN THAT THE PRICE OF A BITCOIN WILL GO UP, IT’S JUST A PARAMETER!!!

The impact of bitcoin dominance on investor sentiment

An increase in btc dominance usually indicates that the market is more defensive and more cautious about other cryptocurrencies (ethereum, ripple, shiba inu). In such periods investors take less risk when it comes to investing in the rest of the cryptocurrencies and are more likely to invest in bitcoin as it presents lower risk. On the other hand, a decline in Bitcoin’s dominance can be seen as a period when the appetite for investing in the other cryptocurrencies increases. In these periods we usually see the market become much more volatile and some cryptocurrencies have a spectacular rise in a small time frame.

The relationship between other cryptocurrencies and bitcoin dominance

When the dominance of BTC usually increases the price and dominance of other cryptocurrencies (also called altcoins) decreases or remains constant. And when bitcoin’s dominance decreases, then the other cryptocurrencies accumulate capitalization and their price increases. However this is not a general rule of thumb and is not advice to invest, in case you see this happening.

Where can I buy bitcoin in Romania in 2025?

If you want to buy bitcoin we recommend using the easiest exchange service in Romania, the Abarai platform. Here you can use whatever currency you want (EUR, USD, RON, GBP etc…) and you can choose the payment method that suits you best (Credit/debit card, bank transfer, Paypall, Netseller, Skrill etc…) The transaction takes place in a few minutes and does not require the creation of an account. More details about the process can be found in this article.

In case you have other cryptocurrencies, say Ethereum and you want to convert it into Bitcoin you can use the swap service. This service does not require any personal data and the transactions are instant. There are currently over 2200 cryptocurrencies to choose from.

Factors affecting bitcoin’s dominance

Changes in the price of bitcoin

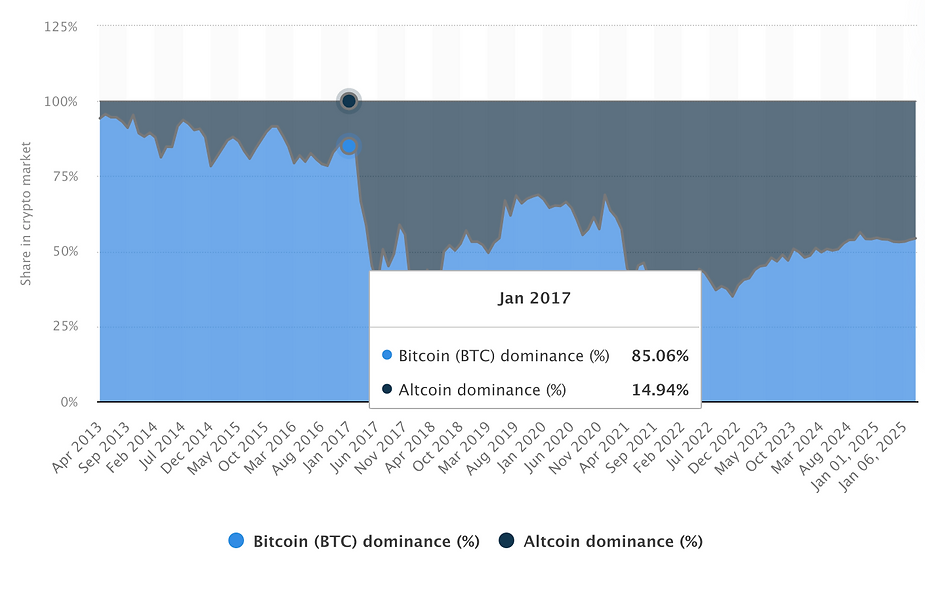

At the beginning of 2017 the price of a bitcoin was $997. That year was a bull market cycle, so by May of that year the price had crossed the $2,000 threshold reaching a record high for that period at the end of the year, over $19,000.

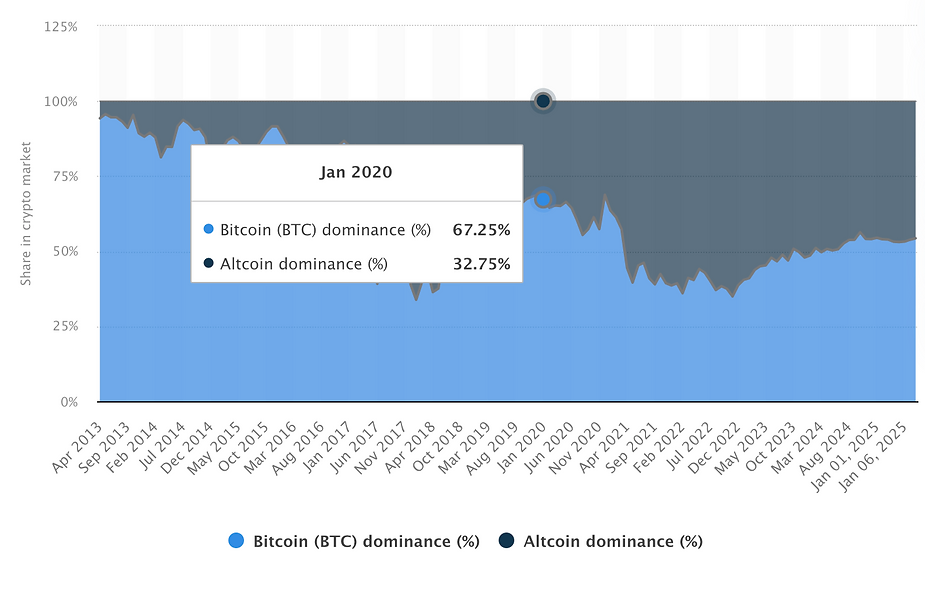

If we were to look at the chart at the beginning of 2017, BTC dominance was 85%

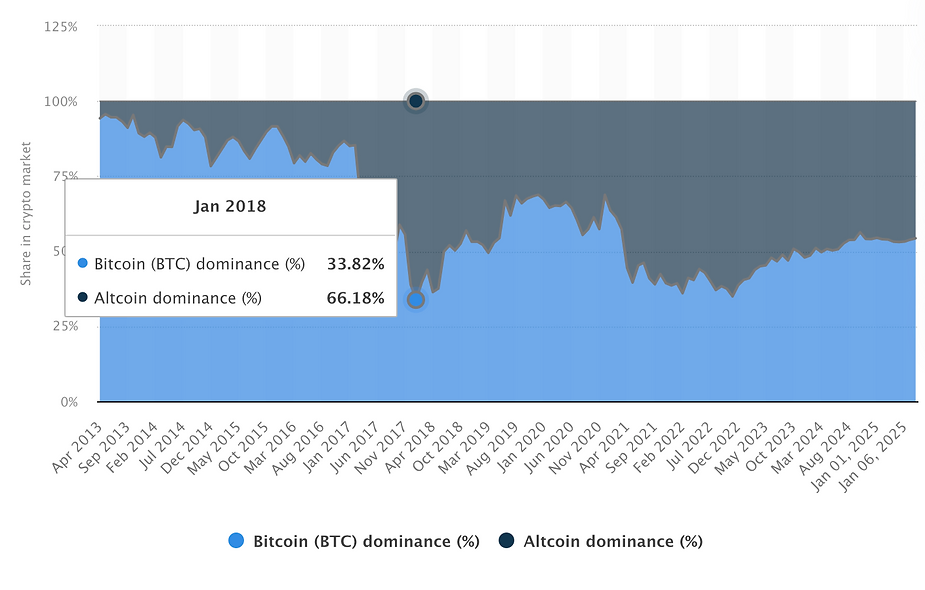

In 2018 the price dropped dramatically, registering values of around 3 000 USD, during this period the capitalization of bitcoin but also the dominance of btc in relation to other cryptocurrencies decreased. Then investors’ confidence was shaken and this was reflected in the dominance of btc.

Since the beginning of 2020, more and more institutions have started investing in Bitcoin and its price has gone up again. Famous companies such as Tesla or Microstrategy have invested heavily, along with other well-known investment funds or other large companies and the price has reached a new record high for the period in question 60 000 USD.

btc dominance in January 2020. source https://www.statista.com[/caption]

btc dominance in January 2020. source https://www.statista.com[/caption]Other cryptocurrencies coming to market and growing in popularity

As other projects have attracted investors’ attention, the altcoins market has evolved greatly. If at first only bitcoin was an investment, cryptocurrencies such as Monero, Ethereum or Litecoin have attracted considerable capitalization.

The cryptocurrency with the largest capitalization is Ethereum, the cryptocurrency created by Vitalik Buterin, Gavin Wood and Toobit has had a spectacular progress since its launch on 30.07.2015 . The concept proposed by the founders was successful because it complemented bitcoin, more precisely on the Ethereum infrastructure smart contracts (smart contracts) and decentralized applications (dApps) were developed.

Another very popular cryptocurrency is Monero, a cryptocurrency that offers its users much greater anonymity than Bitcoin. This cryptocurrency currently has a capitalization of USD 3.9 billion. This cryptocurrency was launched in 2014 and since then there has been a lot of controversy regarding the functionality of this cryptocurrency. In particular the authorities are very unhappy because this cryptocurrency can be used for illegal purposes and it is very difficult for investigators to find the people associated with the addresses.

Launching new cryptocurrencies

The cryptocurrency market is constantly evolving and growing with the emergence of new projects and virtual currencies.

Cardano (ADA): is a blockchain platform based on scientific research. In 2020 and 2021, it has skyrocketed in popularity and its market capitalization has grown rapidly. Cardano is known for its smart contracts and sustainable blockchain solutions.

Polkadot (DOT): is a powerful project that enables multiple blockchains to work together. Launched in 2020, Polkadot has quickly become popular and has a large community of supporters.

eGold (EGLD): is a cryptocurrency developed by Elrond, a Romanian project that emphasizes transaction speed and very low costs. eGold is used for many DeFi projects and is appreciated for its innovations.

Shiba Inu (SHIB): is a cryptocurrency inspired by a meme, but which quickly gained popularity due to its large and enthusiastic community. Although it started as a “fun” coin, many people now consider it a serious investment.

Solana (SOL) was created as a blockchain platform that offers fast and cheap transactions. In 2021, it became extremely popular and has become one of the most widely used platforms for DeFi projects and NFT marketplaces.

How can I find out what BTC dominance is?

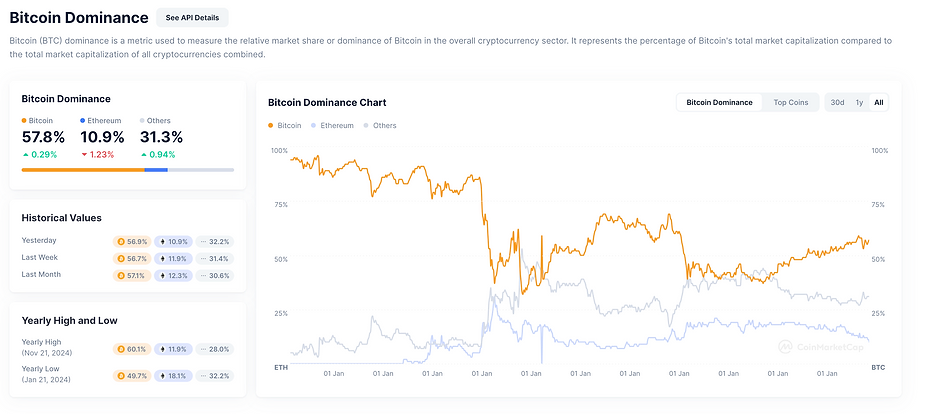

The easiest way to find out what the BTC dominance is is to use a platform that measures this parameter in real time. In our analysis we used platforms like TradingView or Coinmarketcap.

If you want to see the btc dominance in real time you can go to https://coinmarketcap.com/charts/bitcoin-dominance/ and as a result you will get a picture like the one below:

source: www.coinmarketcap.com[/caption]

source: www.coinmarketcap.com[/caption]

Key aspects to remember:

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total cryptocurrency market capitalization. It is an important indicator that shows how strong Bitcoin is in the market and the level of investor confidence.

How is it calculated?

It is calculated by dividing Bitcoin capitalization by the total cryptocurrency market capitalization.

What does it mean if Bitcoin’s dominance decreases?

When dominance decreases, altcoins become more popular and attract more investors willing to take risks.

How do altcoins influence Bitcoin dominance?

The increasing capitalization of altcoins brings diversity and competition, which leads to decreasing Bitcoin dominance.

Where can you check Bitcoin dominance?

You can track the data on platforms like CoinMarketCap and TradingView.

Discover Abarai:

Abarai is a Romanian exchange platform that offers instant exchange services, Romanian language support and full transparency.