XRP is one of the largest cryptocurrencies on the market, with a total capitalization of $130.11 billion. Unlike most traditional cryptocurrencies, XRP was not created as an alternative to the global financial system, but as a complement to it, with the aim of facilitating fast and efficient transfers between different currencies.

The interface of this platform is simple and intuitive.

No complicated KYC for amounts under 5000 lei. In 90% of the cases you don’t need an ID card or passport.

Abarai is a non-custodial exchange: You use your own wallet to store your funds.

What is XRP and what does it do?

XRP is built on XRP Ledger, an open-source network that aims to revolutionize cross-border transfers.

What is XRP

If you’re wondering what XRP is, then you should know that this cryptocurrency was launched in 2012 by the company Ripple Labs, founded by Jed McCaleb, Chris Larsen and Ryan Fugger. Ripple Labs provides decentralized payment solutions based on blockchain technology. This company has developed the core technology behind XRP, with the main goal of creating a system that eliminates the problems faced by traditional banking systems, such as long processing times and high costs.

XRP has a fixed number of coins on offer, just 100 billion tokens created forever.

99.98 billion XRP are already in circulation.

80 billion are held by Ripple, of which 55 billion are locked in escrow accounts.

20 billion is allocated to the founders and development team.

How XRP Ledger transforms the way you transact

To understand what XRP is all about, we’ll outline the benefits XRP Ledger’s network offers users.

Incredibly low costs: Just $0.0002 USD per transaction – XRP is ideal for daily transfers or large-scale operations.

Impressive speed: Transactions completed in 3-5 seconds, regardless of location or amount transferred.

High Scalability: Supports up to 1,500 transactions per second, ensuring a smooth experience even during peak periods.

Sustainability: XRP is carbon neutral, so it is energy efficient.

Innovative features:

First integrated DEX (Decentralized Exchange): Exchange assets directly on the ledger, without intermediaries.

Custom tokenization: Easily create and manage digital tokens directly on the protocol.

The technology behind XRP

XRP runs on a distributed ledger called the XRP Ledger. Each transaction is validated by a network of independent nodes that help maintain security and transparency. Instead of using mining, the XRP Ledger uses a fast consensus process known as the Ripple Protocol Consensus Algorithm (RPCA), a protocol that allows for near-instantaneous transactions with minimal cost.

Here are some details on how it works:

Unique Node List (UNL) Validators:

XRPL relies on a network of trusted validators, which are selected by network participants. These validators form a Unique Node List (UNL).

Consensus by quorum:

Transactions are validated by consensus of a group of validators.The validators in the UNL verify each transaction. If the majority agree that the transaction is valid, it is added to the register.

For users who want to make payments in different currencies, XRP acts as a bridge, converting currencies at competitive rates. If you want to better understand what XRP is and the technology behind this cryptocurrency, read the official whitepaperhere.

What is XRP for real app developers? XRP use cases

XRP is mainly used for:

Cross-border transfers

Many banks use the Ripple network to transfer money between countries quickly and cheaply.

On-demand liquidity

XRP gives institutions instant access to liquidity, eliminating the need for reserve accounts in multiple currencies.

XRP Price: From pioneer to performer (2013 – 2025)

XRP Price’s performance can be divided into several important phases:

Initial phase (2013-2017): modest launch and first increases

At the time of its launch in 2013, XRP had a price of just USD 0.0056. In the early years, the currency experienced slow growth, largely due to a lack of public awareness of cryptocurrencies. However, towards the end of 2017, the price of XRP peaked at almost USD 3, sustained growth:

– The bullish trend existing at that time the cryptocurrency market.

– The closing of strategic partnerships, such as those with American Expres and Santander.

– Speculation from investors, who saw XRP as an opportunity with potential.

Collapse and stagnation (2018-2020)

After the crypto bubble in 2017, XRP, like many other digital currencies, suffered a drastic drop, hitting a low of around $0.24. During this period, the lack of regulatory clarity and increasing competition in the financial payments industry contributed to the price stagnation.

Towards the end of 2020, however, a major event occurred that shook the crypto world. The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs. This legal action had a significant impact on investor perceptions, contributing to the stagnation of the XRP price in the following period.

Recovery and legal uncertainty (2021-2023)

Despite the legal issues, XRP has shown resilience and trading prices have remained relatively high. In early 2021, XRP was trading around USD 0.30. In April 2021, amid increased excitement in the crypto market, XRP peaked at around USD 1.90. Throughout 2022, despite volatility, XRP maintained a support level around USD 0.40.

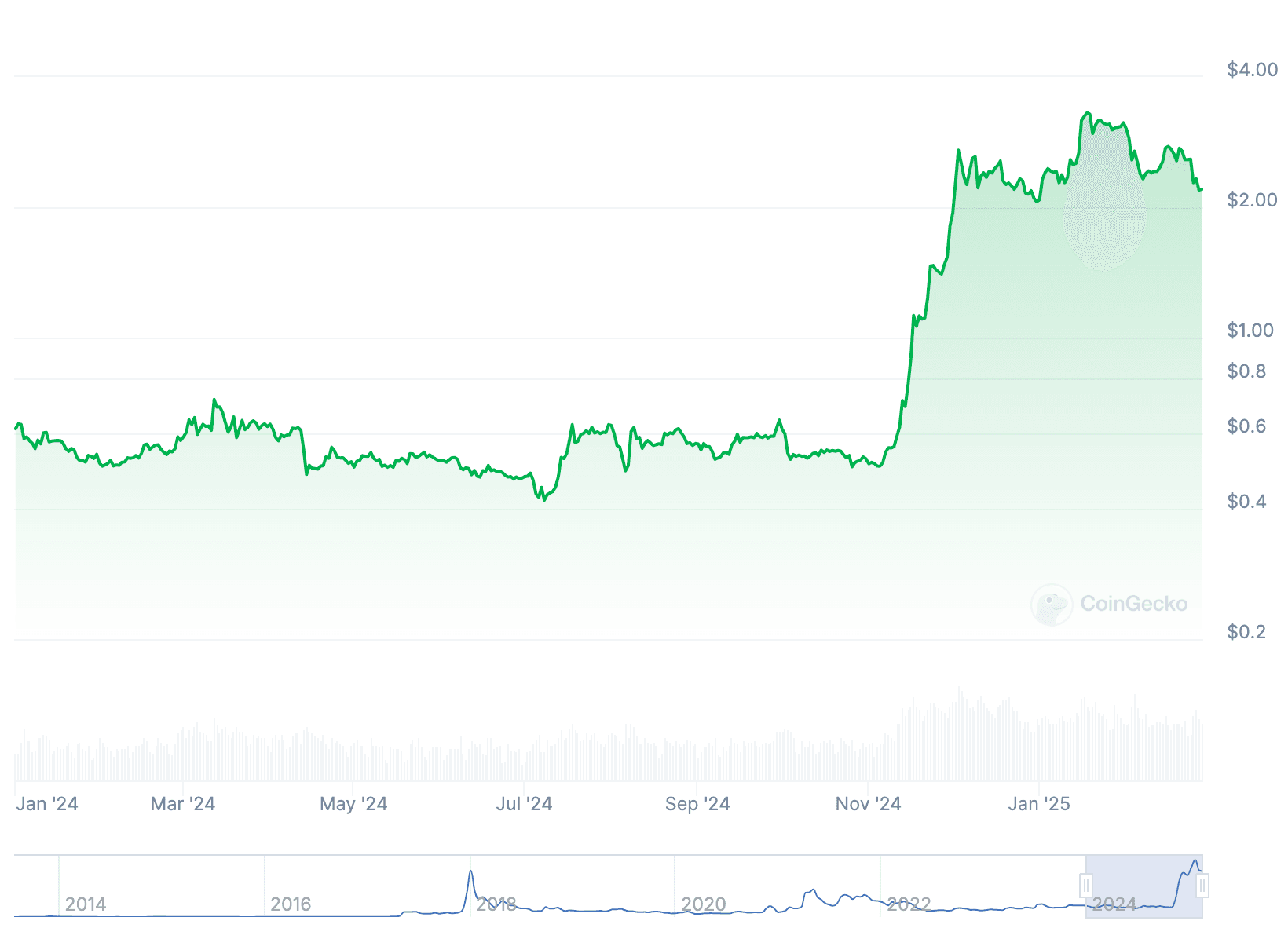

Further developments (2024-2025)

In July 2023, a partial decision by a US court clarified that XRP will not be considered a security. This long-awaited news generated strong optimism among investors. In the first days after the announcement, XRP rose rapidly, reaching a peak of USD 0.85. However, shortly afterwards, there was a correction and the price stabilized around USD 0.60. From November 2024 onwards, however, we see a spectacular price increase, with XRP reaching a value of around USD 3.35 by the end of January 2025.

What drove this increase?

1. The approval of Bitcoin ETFs and increased institutional investment

A major factor that boosted the entire crypto ecosystem, including XRP, was the approval of Bitcoin ETFs. This step has:

Opened the crypto market to a new wave of institutional investors.

Generated increased confidence in digital assets among traditional financial market players.

2. Forged new partnerships and increased adoption rate

Another reason for optimism around XRP is the steady expansion of the Ripple network through strategic partnerships. In 2024, Ripple signed agreements with financial institutions on multiple continents, including:

Banks in Asia and Europe to implement fast cross-border payments.

Regional remittance platforms that use XRP to facilitate fast transfers between countries.

XRP, Bitcoin or Ethereum?

XRP is a popular and well-regarded cryptocurrency, but different in functionalities from Bitcoin (BTC) or Ethereum (ETH). Below, we look at the main differences, including purpose, consensus mechanism, transaction speed and total supply.

XRP vs. BTC

Although XRP and Bitcoin are part of the same industry, they are fundamentally different.

Purpose

Bitcoin was created as an alternative to fiat currency, offering a decentralized form of payment.

XRP, on the other hand, is a tool to improve existing financial systems.

Consensus mechanism

Bitcoin uses a proof-of-work (mining) mechanism, which is energy-intensive.

XRP uses a protocol called XRP Ledger Consensus Protocol, which does not require mining and makes the processing more energy efficient.

Transaction speed

Transactions with XRP are processed in seconds, unlike bitcoin, where it can take minutes to an hour for confirmation.

Total supply

XRP has a limited total supply of 100 billion coins, all pre-mined, unlike bitcoin, which has a maximum supply of 21 million coins generated gradually through mining.

XRP vs. ETH

Both XRP and ETH are among the best-known cryptocurrencies, but there are major differences between them:

Purpose

XRP is developed to facilitate fast, cross-border payments, and is primarily intended for banks and financial institutions.

ETH is designed as a platform for smart contracts and supports the development of decentralized applications (dApps).

Consensus mechanism

XRP uses a consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA), which does not require mining. This significantly reduces energy costs.

ETH, as of Ethereum 2.0, uses the Proof-of-Stake (PoS) mechanism, which is more environmentally friendly than traditional Proof-of-Work, but not as environmentally friendly as XRP.

Transaction speed

XRP can process transactions in about 3-5 seconds,which makes it much faster compared to many other cryptocurrencies.

ETH takes about 15-30 seconds or more to process a transaction, depending on network congestion.

Total supply

XRP has a total supply limited to 100 billion coins.

ETH has no total limit, which raises questions about long-term inflation.

The future of XRP in the crypto market: growth or stagnation?

The evolution of the XRP price in the coming period is influenced by a multitude of factors, and financial experts have diverse opinions. Here is a summary of trends and predictions, taking key factors into account:

Factors influencing the future of XRP

Legal regulations

The final resolution of SEC vs. Ripple will have a major impact. Favorable regulatory clarity could open doors for massive institutional adoption.

Global crypto regulations will play a crucial role.

Adoption and utility:

The expansion of RippleNet and partnerships with financial institutions will strengthen the utility of XRP in cross-border payments.

Ripple’s technological development and new product launches will increase the value of XRP.

Crypto Market Trends:

The growth cycles of the crypto market will influence the price of XRP.

Approval of crypto ETFs and institutional interest will affect the overall market.

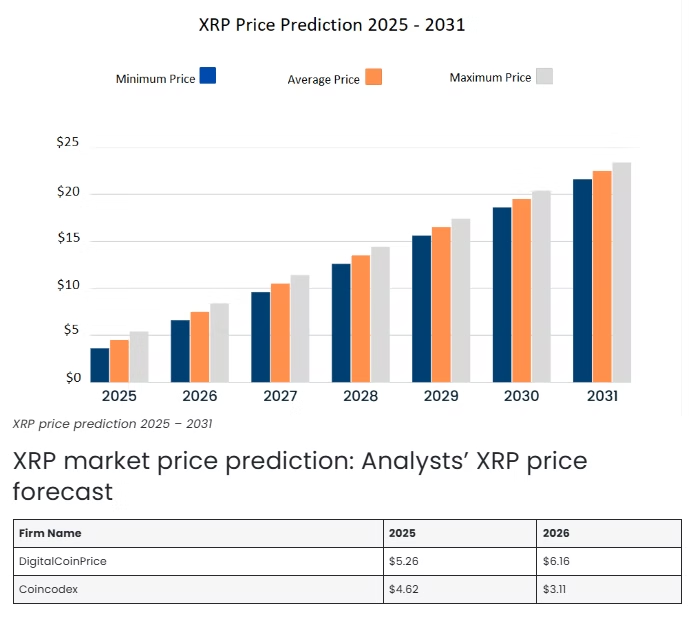

Trends and predictions (2025-2030)

2025:

Increased regulatory clarity could lead to a significant increase in XRP price.

Institutional adoption and strategic partnerships will strengthen XRP’s position.

Some analysts predict that XRP could reach values as high as USD 5.

XRP could become a dominant cross-border payment solution as adoption continues to grow.

In the long term, some analysts predict that XRP could reach values in excess of $10 if all conditions were met.

Is it worth investing in XRP? The pros and cons

Pros

1. Developing partnerships with numerous financial institutions

Ripple, the company behind XRP, has numerous partnerships with reputable banks and financial institutions, including Santander, American Express and Bank of America. These collaborations validate the technology behind XRP, so a potential investment in this cryptocurrency, if we look at it from this point of view, could, over time, pay off.

2. Increasing adoption rate

Ripple is constantly working to integrate XRP into existing financial systems. While other cryptocurrencies are perceived as speculative tools, XRP has a solid foundation as a usable asset in real global transactions. Increased adoption of cryptocurrency could lead to a price appreciation in the market, making the investment a potentially successful one.

Arguments Against

1. Legal issues

One of the biggest controversies related to XRP is the legal action initiated by the US Securities and Exchange Commission (SEC ) against Ripple. The SEC accused Ripple of selling XRP as an unregulated security. This case had a negative impact on the price of XRP and created uncertainty for potential investors.

2. Perception of centralization

Although XRP runs on a blockchain, there are critics who argue that Ripple controls a significant proportion of XRP tokens. Unlike other cryptocurrencies that are considered more decentralized, this perceived centralization raises concerns about market manipulation.

3. Lack of utility for ordinary users

For individual users, XRP does not provide an immediate use case outside of transactions. In comparison, other cryptocurrencies such as Ethereum,Solana, Polkadot, Ada offer functionality such as smart contracts and decentralized applications.

4. Price swings

Like any other cryptocurrency, XRP is subject to price fluctuations. While these swings can generate quick gains, they also pose considerable risks for more conservative investors.

5. Fierce competition

Although Ripple has a significant head start in the area of cross-border payment solutions, it faces increasing competition. Other cryptocurrencies such as Stellar (XLM) are built to solve similar problems and may gain ground on XRP.

If you want to learn more about cryptocurrencies, you can find articles with valuable information on the Abarai blog. We recommend you to read: