The crypto market has captured the attention of the financial world in recent years, becoming one of the most innovative and dynamic industries, a global ecosystem where users can buy and sell digital currencies. How much is a bitcoin worth at the moment and what factors influence its price? Find out from this article the answer to the question how much a bitcoin is worth at the moment and what experts predict for its future development.

If you are interested in buying cryptocurrencies , you can use the Abarai platform, the only digital currency exchange in Romania that offers telephone assistance in Romanian, as well as the possibility to trade amounts up to 5000 RON without presenting an ID or ID card.

Crypto market at a glance

The future of the crypto market is certainly promising. The increasing pace of adoption of digital currencies by large investment firms as well as growing user interest in decentralized payment methods will continue to contribute to the diversification and expansion of the cryptocurrency market.

What are cryptocurrencies?

Cryptocurrencies are cryptographically secured digital currencies that run on a decentralized network of computers known as the blockchain. All transactions are recorded and validated without the intervention of a central authority or bank.

Basically, the blockchain works like a digital ledger made up of blocks. Each ‘block’ contains specific data and once added to the chain, it becomes almost impossible to change.

Common activities in the crypto market

The crypto market includes several activities, but the most common are the following two:

Cryptocurrency trading: this activity involves buying and selling digital currencies, such as Bitcoin, Ethereum, Doge, Solana, on specialized trading platforms in order to make a profit. This practice requires a thorough knowledge of trading, otherwise it can cause significant loss of money.

Investing in cryptocurrencies: Many investors choose to hold their cryptocurrencies for the long term, hoping that their value will increase and thus make a profit. In contrast to trading, investing in cryptocurrencies is based on the belief that these digital currencies will experience significant price increases in the future.

Crypto investments, dangers and challenges

Investing in cryptocurrencies offers significant earning opportunities, but can come with major risks, such as extreme crypto market volatility or security vulnerabilities.

1. Crypto market volatility, a real danger

The crypto market is notorious for its extreme fluctuations. The price of a cryptocurrency can rise or fall significantly in a short period of time. These fluctuations can generate impressive gains but also considerable capital losses.

2. Security vulnerabilities

Crypto investors can easily become targets of hackers or victims of online phishing attacks. Insecure platforms, compromised wallets are just some of the problems you can face. It is essential to use secure crypto wallets and avoid sharing personal data. If you want to learn more about crypto wallets, we invite you to read the article “Cryptocurrency wallet: Ledger, the perfect solution for investors”.

How much is a Bitcoin today

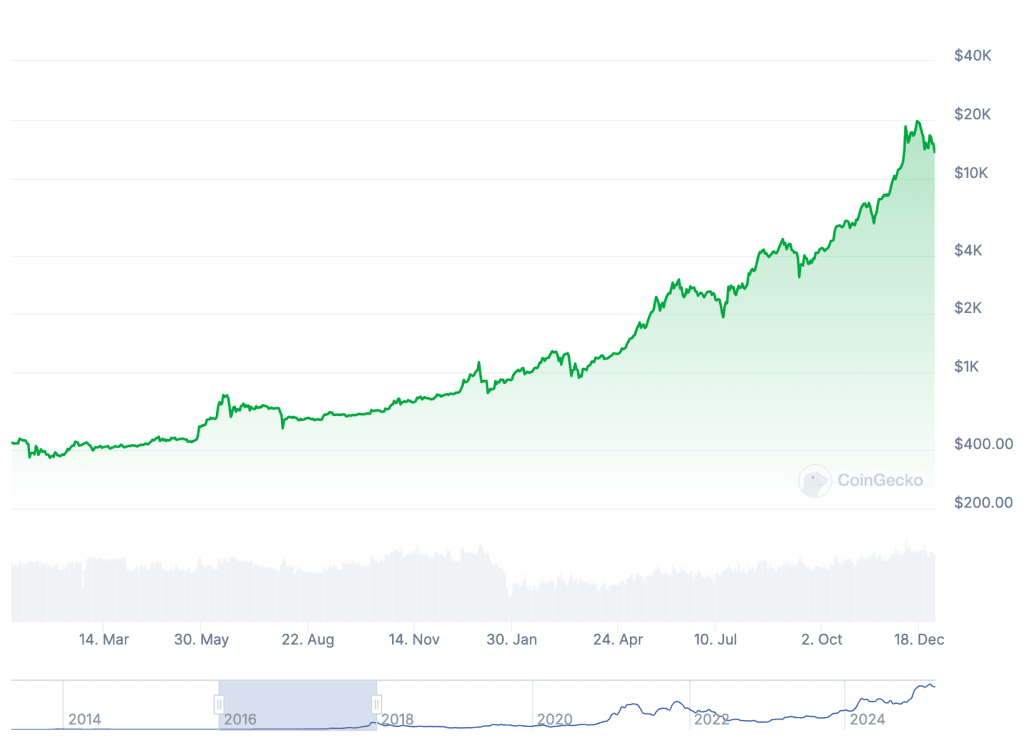

Bitcoin is the first cryptocurrency ever created and one of the most popular among investors. The currency was launched in 2009 by a person known by the pseudonym Satoshi Nakamoto and aimed to facilitate direct financial transactions between users. Over time, bitcoin has gone from almost non-existent to values in the hundreds of thousands. If you’re curious “how much is a Bitcoin” we must first analyze how the value of the cryptocurrency has evolved over time.

Bitcoin’s beginnings (2009 – 2010)

On January 3, 2009, the first block of the network, dubbed the “Genesis block”, is mined. Miners engaged in the mining process more out of curiosity and to participate in the experiment than for financial gain.

At this time, Bitcoin had virtually zero value because it was not yet traded on public markets. The turning point for Bitcoin came in 2010, when the first commercial transaction took place.The event is known as “Bitcoin Pizza Day” and took place on May 22, 2010. Specifically, 10,000 BTC was used to buy two pizzas. The approximate value of a Bitcoin at that time was around 0.004 USD.

Slow but steady growth (2011 – 2013)

2011, a historic year for Bitcoin, the first year in which the cryptocurrency reached parity with the US dollar (1 BTC = 1 USD). This symbolic moment caught the attention of early investors, so that at the end of 2013, Bitcoin experiences a meteoric rise and surpasses, for the first time, the value of 1,000 USD. Unfortunately, within only a few months, the price of Bitcoin undergoes a severe correction and reaches a value of around 200 – 300 USD.

Big waves of interest (2016 – 2017)

As Bitcoin becomes known, demand increases exponentially. In 2016, bitcoin was trading at around 600 USD. In December 2017, bitcoin reaches an all-time high of almost 20,000 USD and starts to attract the attention of big investors.

Bearish vs bullish cycles (2018 – 2020)

After peaking in 2017, bitcoin’s price dropped to around USD 3,000 in 2018. The cryptocurrency market has entered a bearish (falling) cycle. Many skeptics have declared the “death” of Bitcoin. But true cryptocurrency enthusiasts knew that volatility is part and parcel of the cryptocurrency’s evolution, so from 2020 onwards, Bitcoin began to regain ground and return spectacular returns to investors. At the end of 2020, bitcoin again exceeds the value of 19,000 USD.

Institutional era (2021 – 2022)

Companies such as Tesla and large financial institutions have started to incorporate Bitcoin into their portfolios. Essentially, a new era, often referred to as the “era of Bitcoin institutionalization”, has dawned.

In November 2021, Bitcoin reached an all-time high of nearly USD 68,000, the highest price in its history to that point. However, due to global economic uncertainties, the end of 2022 was marked by significant corrections and Bitcoin falls below the $20,000 USD mark (more precisely, on December 1, 2022 the price of a Bitcoin is around $16,000 USD).

How much is a Bitcoin today, February 17, 2025

As of February 17, 2025, the price of a Bitcoin is around 96,000 USD, according to exchange platforms. This price is the direct result of the ratio of supply and demand for bitcoins in the market today. In contrast to the daily price, the intrinsic value of a Bitcoin is something else entirely, thanks to its innovative functions, the revolutionary technology underpinning the cryptocurrency and its potential to serve as a store of value.

Want to invest in bitcoin?

Here are some tips that can help you develop a properly informed strategy:

Stay informed on global events and financial regulations.

Avoid reacting impulsively to daily price fluctuations.

For a complete picture of the market and opportunities, use platforms that provide real-time analysis and updates.

Although these tips can guide you when deciding to invest in the crypto market, they are not enough to protect you from risks.It is also essential to be aware of the emotions that accompany your investment decision. An important psychological factor is the fear of missing out on opportunities, known by the acronym FOMO (Fear of Missing Out).

FOMO, the crypto market and investor behavior

FOMO can be defined as the feeling of anxiety, fear or dread felt by a person when they believe they have missed out on a valuable opportunity. In crypto investing, this term is quite common, as the cryptocurrency market is extremely volatile and rapid price changes can induce this feeling in participants.

For example, when the price of Bitcoin increases significantly in a relatively short period of time, many investors feel FOMO, i.e. they start to fear that they will miss the opportunity to profit from this increase. This feeling can lead to impulsive buying decisions, which may later prove unwise if the market experiences price corrections. In addition, the plethora of stories in the media about investors “getting rich overnight” fuels the feeling that “you may miss the opportunity of a lifetime”.

Facebook, YouTube, Twitter, Telegram and other platforms are abuzz with talk of “the next big thing in the crypto market,” which is intensifying the pressure to act quickly and unchecked.

In this context, to deepen your understanding of the cryptocurrency market dynamics and avoid rash decisions, we recommend reading the article “Cryptocurrency market: the $3 trillion industry that almost nobody understands”, available on our blog. This article provides a detailed insight into the risks, strategies and realities behind the promises of get-rich-quick.

How does FOMO influence investment decisions?

Fear of missing out can have a powerful impact on financial psychology and can lead to significant strategic mistakes such as:

1. Impulse buying

FOMO causes investors to purchase cryptocurrencies without doing thorough due diligence. They may buy at a “peak” moment only to see the price drop sharply later.

Example: An investor sees Ethereum rising 5% in a few hours and decides to buy, but soon after, the price drops 8%.

2. Overexposure to risk

Investors influenced by FOMO are prone to ignore risk management rules, invest larger amounts than they should and remain exposed to large losses.

3. Neglecting portfolio diversification

In the rush for “golden” opportunities, investors may forget the rules of portfolio diversification and focus their resources on a single cryptocurrency or project. A diversified portfolio protects investors against massive losses when the market fluctuates.

Tips for managing FOMO and making rational decisions

FOMO can be controlled with discipline, knowledge and a sound strategy. Here are some essential tips that will help you avoid FOMO when looking to invest in the crypto market:

Educate yourself before investing

Understand in detail the cryptocurrency or projects you plan to invest in. What is its usefulness? Analyzing the information reduces the fear of missing something big and increases your chances of success.

Plan a clear investment strategy in advance:

Determine how much you are willing to invest.

Decide when to buy and especially when to sell.

Define your risk tolerance.

Avoid making decisions under pressure

If you feel that you are acting under pressure, take a step back and coolly analyze the situation.

Start small

Until they gain confidence, many beginners choose to allocate only a small portion of their savings to crypto investing.

Diversify your portfolio

Don’t put all your eggs in one basket. Invest in multiple cryptocurrencies that meet strong validation criteria.

One useful strategy is DCA (Dollar-Cost Averaging)

This strategy involves allocating fixed amounts at set intervals, regardless of market fluctuations. Investing gradually will protect you from sudden fluctuations.

Limit time spent on social media

Social channels can be a hotbed of FOMO. Reduce exposure to hype and learn to filter information.

Key things to remember

☑️ Factors influencing Bitcoin price:

Supply and demand influence the price of bitcoin by determining its value in the market: high demand and limited supply drive the price up, while low demand and steady or increasing supply can drive the price down.

Macroeconomic events – High inflation or banking crises often increase interest in bitcoin as a store of value or means of protection against inflation.

Institutional adoption – As more and more large companies and financial institutions choose to include bitcoin in their asset portfolio or accept it as a means of payment, its price will continue to rise.

☑️ Crypto investments can generate significant gains, but should be approached calmly and rationally. Im impulsive investments, dictated by the fear of missing out on opportunities, can lead to significant losses of money.

☑️ Be careful not to invest more than you can afford to lose, and don’t let your emotions get the better of you. Instead, follow a well-defined plan and remain disciplined. A well-calculated decision is always more valuable than catching a “passing trend”.

At the end of this article, we invite you to explore other valuable resources about bitcoin and cryptocurrencies: