In recent years, Bitcoin has become a focal point of discussions about the future of the global financial system. Although at first the cryptocurrency was viewed with skepticism, today bitcoin has earned its status as “digital gold,” with the potential to totally reshape the way we understand and use money. Want to learn more about the topic of bitcoin price, how to buy and sell bitcoin safely? Visit the Abaraiplatform and explore the easiest and fastest cryptocurrency trading options.

What is bitcoin and how did it all start?

In this article we look at what bitcoin is, how the cryptocurrency has evolved over time, the price of bitcoin in 2025 and what it really means to “invest” in this digital currency.

Bitcoin price and the transformation of the digital economy: A look into the past

Bitcoin emerged in 2009, created by an anonymous figure known as Satoshi Nakamoto. The goal was a revolutionary one: to establish a decentralized digital monetary system that would allow transactions without the intervention of central banks.

In just a few short years, the value and credibility of bitcoin has skyrocketed. From a value of just a few cents in 2009, the price of bitcoin in December 2024 reaches an all-time high of around USD 107,000 per unit.

Bitcoin, the “star” cryptocurrency

Bitcoin is often called “digital gold” – but why? Unlike traditional currencies issued by governments, Bitcoin is limited to a fixed number of 21 million units. This limitation gives Bitcoin a rarity comparable to gold and makes it a “star cryptocurrency”.

How to start investing in bitcoin? Simple steps for beginners

Choose a secure platform

Opt for a well-known platform such as Abarai, a non-custodial exchange where you can buy or sell cryptocurrencies simply and quickly. No need to make an account or register. For 90% of transactions under 5000 RON, no ID card or ID is needed.

Create a digital wallet

Do your research

Be informed about risks and trends before investing. Understanding risks and market trends can help you make informed decisions and minimize your exposure to significant losses. Don’t just rely on rumors or spur-of-the-moment impulses, but carefully analyze the factors that influence prices.

Invest only what you can afford to lose

Bitcoin can offer gains when we have a bullish market. But the volatility of its price is an important factor to consider when deciding to invest, as price fluctuations can be large and affect your investment.

Bitcoin price in 2025, possible scenarios

The optimistic scenario

Some analysts and experts predict a bitcoin price that could surpass the USD 200,000 threshold by December 2025. This prediction is supported by several arguments:

The increasing pace of cryptocurrency adoption among financial institutions could direct a massive flow of capital to Bitcoin.

The 2028 halving event will further slow the pace of new coin issuance, reinforcing the deflationary nature of Bitcoin. The most recent Halving, in April 2024, was followed by a price increase.

Another factor that could contribute to a possible rise in the price of Bitcoin is global economic instability. Investors could perceive the currency as a hedge against inflation.

The moderate scenario

A more conservative scenario estimates a Bitcoin price between USD 50,000 and USD 80,000 by December 2025:

The market becomes saturated and the pace of growth slows.

New competitors, such as other cryptocurrencies, enter the game and attract some of the capital.

Regulations remain positive but do not stimulate adoption.

The worst-case scenario

In the event of unfavorable regulations or a generalized crash of the cryptocurrency market, experts predict a possible Bitcoin price below $20,000, similar to previous bearish cycles:

People no longer trust Bitcoin because of security breaches or cyberattacks.

Most investors start selling because they believe the all-time high has been reached, so it would no longer make sense to hold the cryptocurrency .

We know from previous cycles that it only takes a little bit for the “bubble” to burst and people will sell massively. In general, optimistic news spreads quickly, but negative news certainly spreads much faster and has a much bigger impact on the cryptocurrency market.

Bitcoin is considered “digital gold”, a revolutionary cryptocurrency that has gained popularity due to its high potential to generate financial gains. However, before investing in bitcoin, it’s important to understand the dynamics of the market and weigh the benefits and risks. There are many online platforms that provide real-time updates. Services such as Trading View or CoinMarketCap show you the current price, trading volumes and historical trend.

Practical tips:

Use charts to understand market movements.

Enable notifications for price fluctuations that interest you.

Comparisons with other investment options

Bitcoin is just one of the many investment options available. Here’s how bitcoin investing compares to other more traditional methods:

1. Investing in shares

Advantages: Stocks offer dividends and tend to be less volatile than cryptocurrencies.

Disadvantages: They depend on the economic performance of the chosen companies and require careful analysis.

Bitcoin, on the other hand, is decentralized and does not depend on the profitability of any company.

2. Investing in gold

Advantages: Gold is considered a safe investment and is ideal for diversification.

Disadvantages: The increase in the value of gold is slow compared to the potential gains you can make if you invest in Bitcoin.

However, Bitcoin is often seen as an alternative to gold due to its rarity and the fact that it can be traded quickly, globally.

3. Investing in Bonds

Advantages: Considered a low-risk option suitable for conservative investors.

Disadvantages: Bond yields are generally lower than those offered by Bitcoin.

Bitcoin offers the possibility of much higher gains, but comes with a higher level of risk.

Editor’s note:

Before choosing between different investment options, consider your financial goals and risk tolerance. However, if you choose to invest in bitcoin or other cryptocurrencies, you should keep in mind the high volatility of this market and the fact that possible legislative changes will influence prices.

It’s also good to know that digital wallets are vulnerable to cyber attacks if they are not well protected. You can find out more about digital wallets in our article “Cryptocurrency wallet: Ledger, the perfect solution for investors”.

Challenges and growth opportunities for the cryptocurrency bitcoin

Next, we analyze the main challenges facing the cryptocurrency bitcoin, as well as the remarkable opportunities that can support its continued growth in the coming period.

Bitcoin challenges

1. Price volatility discourages the use of Bitcoin as a stable and predictable means of payment.

One of the biggest challenges for Bitcoin is the extreme volatility of its price. While for some investors this represents an opportunity for quick gains, for others it causes uncertainty and reluctance.

2. Global regulations that differ significantly from country to country

While some countries accept and even encourage the use of bitcoin, others impose harsh restrictions or ban transactions altogether. Regulatory uncertainty creates a significant barrier to expanding the use of Bitcoin on a global scale.

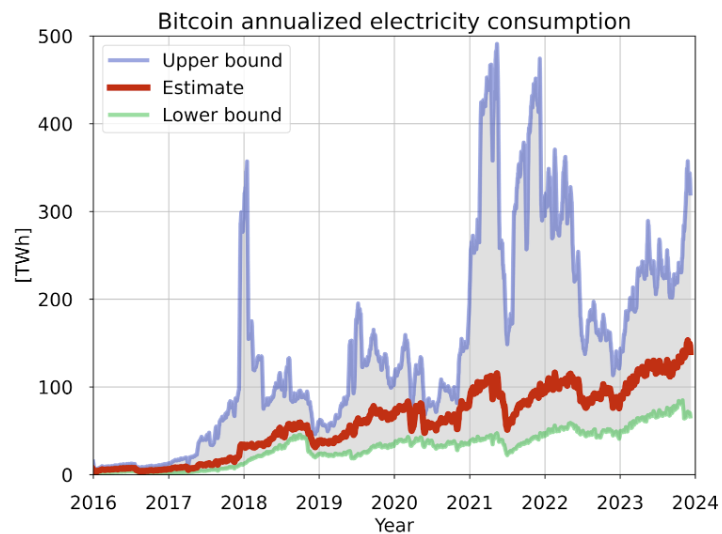

3. Negative environmental impact

Bitcoin mining requires huge amounts of energy and contributes to greenhouse gas emissions. There is currently much pressure on the cryptocurrency industry to find more environmentally friendly solutions.

Source: University of Cambridge

Source: University of Cambridge4. Limited global adoption of cryptocurrency

Although cryptocurrency is extremely popular and widely recognized, its practical use as a means of payment remains limited. Many companies do not yet accept digital currencies, and payment processes with Bitcoin are often slower and more complex compared to traditional methods.

5. Scalability issues

The bitcoin network can process a limited number of transactions per second, which leads to congestion and high transaction fees during periods of intense activity. This scalability issue limits Bitcoin’s ability to compete with other faster payment systems.

Major opportunities for growth

1. Technological development

Technologies such as the Lightning Network offer solutions to scalability issues, reducing transaction fees and accelerating processing. These technical innovations open up new opportunities for the widespread use of Bitcoin.

3. Protection against inflation

In a global economic context marked by financial uncertainty, Bitcoin can be considered as an inflation hedge. Increasing interest in Bitcoin as a financial safe haven asset can significantly contribute to its popularization.

4. Accessibility and decentralization

Transferring funds without intermediaries is a revolutionary change in the financial world. Bitcoin allows anyone, anywhere in the world, to access financial services with a simple internet connection.

5. Building a global community

The Bitcoin community is made up of investors, developers and modern technology enthusiasts who continue to promote and improve the ecosystem, thus providing a solid foundation for the long-term growth of the cryptocurrency.

Bitcoin Long-Term Price – What to expect in the next decade?

Technological adoption, institutional support, innovative solutions to problems such as scalability and environmental impact can make this cryptocurrency a key component of the global digital economy. Among the most important phenomena that could shape the future of Bitcoin over the next decade are:

Increased adoption of cryptocurrency by large financial institutions

One of the most anticipated scenarios for Bitcoin is its adoption, globally, by large financial institutions. Economic downturns and growing demand for cost-effective digital solutions could lead banks and investment funds to consider this cryptocurrency as a viable alternative to traditional currencies.

How could it work?

Integrate bitcoin into financial products such as mutual funds or Exchange Traded Funds (ETFs).

Use in decentralized financial platforms (DeFi).

Increasing use of Bitcoin in everyday transactions

The future could bring widespread use of cryptocurrency in everyday transactions such as online shopping or paying bills. Why. Its functions make it useful to all merchants who want an alternative to traditional payment systems, often slowed down by high fees and cumbersome processes.

Indicators in favor of this change:

The lack of need for elaborate identification documents will allow merchants to quickly implement payments via bitcoin.

Desire to benefit from lower transaction costs compared to traditional ones.

Clear regulations for sustainable cryptocurrency growth

Another important step for the future evolution of bitcoin will be the clarification of regulations at a global level. While regulations may seem a barrier at first, they could bring stability and confidence to the market.

Example of positive regulatory impact:

Reduced risks associated with money laundering.

Increased adoption of Bitcoin by large financial market players.

Integration of Bitcoin in emerging economies

Cryptocurrency could play a vital role in emerging economies, where traditional financial solutions are harder to access. In these regions, Bitcoin could become an efficient solution for transferring value and making payments at much lower fees.

Examples of use:

Faster transfers, lower transfer fees.

Access to savings and investments for those who do not yet have a bank account.

Developing strategic partnerships

To secure its future dominance, bitcoin could benefit from strategic partnerships with a number of large companies. Integration with modern fintech applications or global e-commerce platforms could be the next big step.

The impact of cryptocurrency on the global financial sector

In the long term, Bitcoin has the clear potential to change the way the financial sector works. The decentralized transactions that can be conducted using cryptocurrency and their transparency promise to redefine issues such as the way traditional bank transfer networks operate. Decentralized funding models will certainly gain ground and replace traditional intermediation.

A promising future for bitcoin

Despite significant challenges, cryptocurrency has plenty of opportunities for growth and evolution. Bitcoin’s future looks extremely promising, with great chances of integration into as many sectors of the economy as possible. Bitcoin is becoming an increasingly popular choice among investors and financial institutions.

Note: It is recommended not to invest more than you can afford to lose. Only use trusted platforms for buying cryptocurrencies, such as Abarai.