What taxes do I have to pay if I profit from trading crypto? Have you bought cryptocurrencies (Bitcoin, Solana, Ripple, Ethereum or other crypto) and made a profit? The following article is dedicated to you, we will explain what you need to do if you have to pay crypto tax.

What tax do I have to pay on crypto?

The tax on crypto is currently 10%. There have been numerous news stories, proposals, debates etc… about crypto tax exemption. We documented this news in the article ” Cryptocurrency tax: what taxes do you have to pay if you profit from cryptocurrencies?“

Update for August 2025:PSD membershave proposed that the current 10% rate be increased to 16%. These proposals are under discussion with the other members of the coalition and are intended to come as an amendment to the tax package 1 Source Profit.ro . We will come back if this change will be transposed into law.

If you’ve never bought cryptocurrencies, need support, are a beginner or don’t know where to buy in Romania, then the Abarai platform is the perfect place to start. You can call anytime you have a question or doubt, also for those who already have cryptocurrencies you can do instant swap using the special service.

When do I have to pay crypto tax?

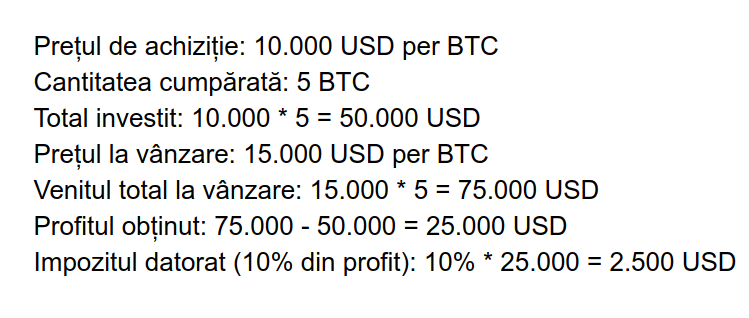

If you have purchased cryptocurrencies and later converted them into fiat money, and after this conversion you made a profit of more than 600 Lei during one year. Then you have to pay crypto tax of 10% of the profit, I will give you an example below to understand very clearly what taxes you have to pay. example: Ana bought Bitcoin at the price of 10 000 USD, the amount she bought is 5 btc.

4 months later the price of Bitcoin reaches 15 000 USD, then Ana decides to sell all the btc she has.

The tax that Ana has to pay is 2500 USD. Below is the way we calculated the tax due to the Romanian state.

What is the easiest way to sell cryptocurrencies? The Abarai platform is the easiest way to sell your cryptocurrencies, you can choose for multiple currencies (Lei, USD, EUR, GBP, CHF, etc…) and for multiple payment methods (Credit Card, Debit Card, Paypal, Skrill, Netseller, SEPA, etc…)

When do I not have to pay tax on cryptocurrencies?

Those who made profits of less than 600 lei in a year are exempt from paying tax on cryptocurrencies.

On which cryptocurrencies do I have to pay crypto tax?

The following definition is given in Law 129 of 2019 1)virtual currencies means a digital representation of value that is not issued or guaranteed by a central bank or public authority, is not necessarily linked to a legally established currency and does not have the legal status of currency or money, but is accepted by individuals or legal entities as a medium of exchange and can be transferred, stored and traded electronically;

So any digital representation of value that has made you a profit is considered virtual currency. So if you made profit on bitcoin or a meme coin that nobody knows about you have to pay crypto tax.

What is the procedure for paying tax on digital currencies (cryptocurrencies)

By May 26, 2025 you have to fill out form 212.

After completing this form which is the single declaration you have several options:

- Online on the ANAF portal (SPV) or through the e-guvernare website

2. In person at the tax office (ANAF institution to which you belong) or by mail (recommended with confirmation)

You can find here instructions for filling in the single declaration.

What happens if I don’t pay the tax on cryptocurrencies?

- Penalties, interest and surcharges of approximately 0.02% per day of the amount due. More details in the document published by ANAF

- If you have high income from cryptocurrencies, the state may interpret that you are tax evasion. If the amount exceeds 1M Lei you can go to jail between 2 and 7 years

I bought cryptocurrencies from Binance or Revolut, do I have to pay tax?

Yes you have to pay crypto tax, no matter where you bought cryptocurrencies from you have to pay tax if you made a profit. In the case of custodial exchanges (which provide you with a digital wallet) there is also a track record which easily proves that you made a profit. These entities also report to the state authorities(ANAF) the activity of their clients.

Key points to remember

- You have to pay crypto tax 10% of the profit made from trading cryptocurrencies, this is crypto tax

- Profit means you bought cheaper and sold more expensive, see example here

- If you made less than 600 Lei profit in a year, you don’t have to pay tax

- No matter what cryptocurrency you traded, you have to pay tax

- No matter where you bought or sold cryptocurrencies, you have to pay tax