Current crypto markets and bitcoin price context

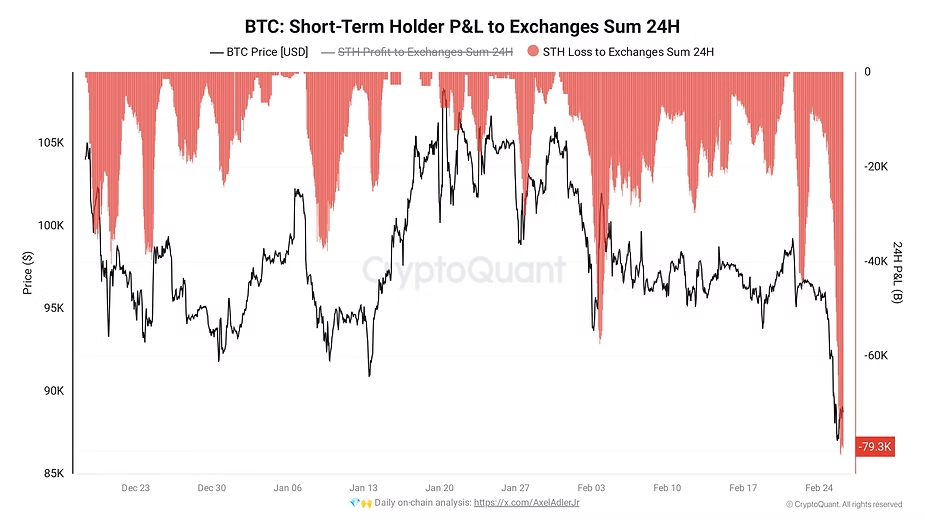

The recent data suggests that many investors are no longer taking risks and are deciding to sell their assets to avoid even bigger losses. A recent chart from CryptoQuant illustrates that within 24 hours, negative profit trades surpassed record highs, indicating extreme volatility in the markets.

Causes to the phenomenon : bitcoin price panic

Panic selling

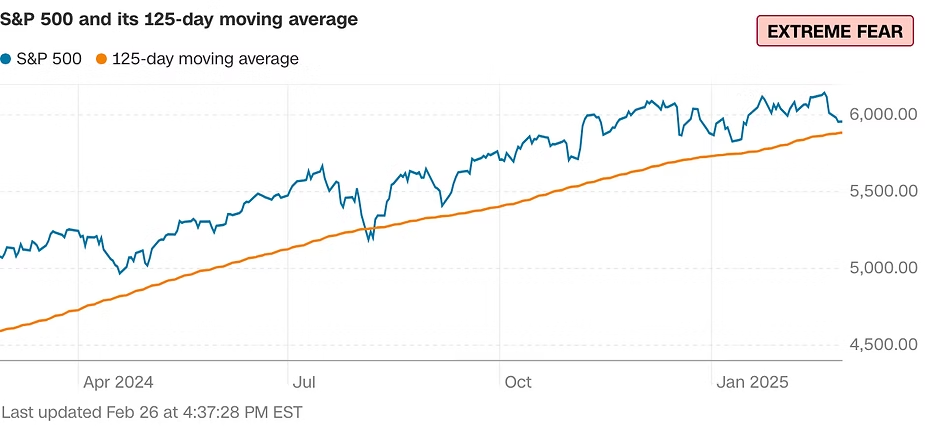

One of the main reasons for this situation was panic selling. As the price began to fall, selling increased rapidly, amplifying panic among investors. Surprisingly, even those who trusted Bitcoin as a safe investment started selling their cryptocurrencies. This created a vicious circle. Each sale led to a further drop in the price, causing even more investors to react emotionally.There are indices that study this phenomenon, this market sentiment. This index is called “fear and greed” and can be applied to several markets. We observe that it’s a generality, that the market feels fear. So CNN indicates that there is extreme fear in all markets.

This sentiment carries over to even the safest ETFs, such as the S&P 500. Don’t know what an ETF is? We offer you the following article“ETF: what does it mean, what is it for? Simple explanation 2025”

All the while, the “fear and greed” index published by the folks at Coinmarketcap, which refers exclusively to the cryptocurrency market, is also gripped by fear, with investors showing apprehension about investing in cryptocurrencies in a way that is quite unlike previous sentiments. So the bitcoin price panic is not peculiar or exclusive, it is rather a general sentiment.

If you’re gripped by fear and want to sell your cryptocurrency or bitcoin, one way to do it instantly is the Abarai platform. In just a few seconds you get the money on your .

The Bybit hack

Another crucial reason was the recent hack of the exchange platform Bybit, where hackers managed to steal Ethereum from the company’s $1.5 billion cold wallet. This heightened the fears of investors already concerned about market volatility. You can read further details about this hack on the article Hackers stole $1.5 billion. Bybit cryptocurrency heist

Analyzing the markets after the fall

What’s next for bitcoin?

James Check, creator of the on-chain data resource Checkonchain, noted that reaching the breakeven point for STH (short term holder) at $80,000 could represent a turning point. This observation is important given the proximity of this level. Check noted that “this area of support should hold,” but added that “beyond 80,000, we don’t have much,” meaning that a drop below this level would generate further panic.

Bear market survival strategies

For committed investors or those looking to get started now, it is crucial to develop survival strategies in this bearish market.

Planning and research: Continuing education about cryptocurrencies is essential. Informed investors make conscious decisions instead of acting on impulse. For example, many investors who have studied price charts have managed to avoid major losses.

Diversify: Don’t limit yourself to bitcoin. Investing in other cryptocurrencies, such as Ethereum or Solana, can reduce risk. According to a study published by CoinMarketCap, diversified portfolios performed 25% better in volatile times.

Political developments and the impact on the cryptocurrency market

Kozyakov said that “the industry expects this position to become tangible through measures such as strategic Bitcoin reserves.” Such an initiative could positively influence the markets and contribute to long-term stabilization.

Market overview

In a crypto market marked by uncertainty, Bitcoin has fallen below €80,000 and the sense of panic is widespread. The current challenges are real, but it’s crucial to remember that every market dip can bring opportunities. In the past, bitcoin has demonstrated a remarkable ability to recover.

By learning from these experiences, we can strengthen our strategies and adapt. Investors must remain focused, educated and prepared to navigate through volatility. With a wise and patient approach, we can find a way out of this bear market and head towards a brighter future for Bitcoin and the entire crypto community.