The cryptocurrency market is a complex digital ecosystem in which crypto assets are used for various functionalities such as payments, smart contracts, decentralized finance (De-Fi) and value storage. Currently, there are thousands of cryptocurrencies that are part of this ecosystem, each with unique characteristics and specific functions that make them stand out.

Despite high volatility in recent years, the cryptocurrency market has continued to grow, attracting both individual investors and large financial institutions. The best place to buy or sell cryptocurrencies in Romania is the Abarai platform. This platform is extremely easy to use and offers phone support in Romanian.

The Value of Bitcoin and the Cryptocurrency Market. Bitcoin’s position in the cryptocurrency market

Bitcoin was launched in March 2009 by Satoshi Nakamoto to provide a decentralized alternative to traditional financial systems. It works similarly to an electronic payment system and allows anyone with an account to send and receive coins without the intervention of a central authority.

Here are three key features of the cryptocurrency Bitcoin:

1. It is a decentralized digital currency – Bitcoin operates on a blockchain network where there is no central bank control. Transactions between parties take place autonomously without the intervention of a third party.

2. It exists in limited quantity – when Bitcoin was created, the source code specified a number of about 21 million coins that could be issued.

3. High volatility – Bitcoin is known for its high volatility, experiencing significant fluctuations in value over time.

Return on an investment in Bitcoin

The return on an investment in bitcoin depends on a number of factors such as global financial, legislative and economic regulation, the supply and demand in the cryptocurrency market at any given time or the pace at which new technological innovations take place.

All of these factors can cause significant price fluctuations, so the decision to invest in cryptocurrencies should be a rational one, based on data and real market trends, not rumors or emotions. Any investment in cryptocurrencies depends on the investor’s financial objectives, risk tolerance and level of awareness. Portfolio diversification and a long-term strategy can help manage risk. If you want to buy cryptocurrencies, you can use the Abarai platform a non-custodial exchange in Romania, which allows fast and secure trading.

Bitcoin Value – Historical Analysis

Next, we will analyze the evolution of bitcoin’s value over time, highlighting the key moments that influenced its value as well as the reasons behind significant fluctuations.

2009 – 2016

At its inception in 2009, the value of Bitcoin was less than one cent. This was followed by a rise to $29.60, peaking on June 8, 2011. Subsequently, the price dropped again, with bitcoin registering a value of around 5 dollars at the end of 2011.

The year 2012 was a basically uneventful year for bitcoin and its price rose by only a few dollars. From 2013 onwards, the cryptocurrency again records significant increases: if at the beginning of 2013, one Bitcoin was worth 13 dollars, in October 2013 the price rises to around 200 dollars and Bitcoin ends the year at a value of 732 dollars.

2017 – 2020

A high point in Bitcoin’s history was December 2017, the month in which the value of Bitcoin reached a value of $19,188 for the first time. However, this rapid rise is followed by a significant price correction, so that in January 2019 the price reaches around 3,500 dollars.

In 2020, the Covid-19 pandemic as well as government economic measures accelerate the rise in the value of Bitcoin. From around $7,500 at the beginning of the year, it reaches $19,000 in November and ends the year at a value of $28,993, thus registering a 416% increase.

2021 – 2023

In 2021, bitcoin’s value quickly surpassed the 2020 record, reaching $40,000 on January 7 and a high of $64,895 on April 14. After a 50% drop in the summer, it rebounded to around $69,000 on November 10, but due to economic uncertainties it will close the year at $46,211.

In 2022, bitcoin continued to fall, dropping below the $30,000 threshold in May and below the $20,000 threshold towards the end of the year. However, it gradually reco recovers from January 2023 and ends the year at $42,258.

2024 and trends

In January 2024, the SEC was forced by the courts to review its rejection of certain bitcoin-related financial products. After the approval of these products, the price of bitcoin reached on March 6 for the first time the historical threshold of $69,210.

In April 2024, the reward for mining a block was reduced from 6.25 BTC to 3.25 BTC (an event known as “halving”) , which “froze” the value of the cryptocurrency for a period of several months.

With the Federal Reserve’s cut in interest rates in September, the price of bitcoin starts to rise again, reaching a new all-time high of $76,999 on November 7 and surpassing $80,000 on November 10. On November 13, Bitcoin’s price surpassed the $91,000 mark and continued to climb, the rise fueled by investors’ excitement over Donald Trump’s promises, such as setting up a “Strategic Bitcoin Reserve” and making America the “crypto capital of the world”.

2025

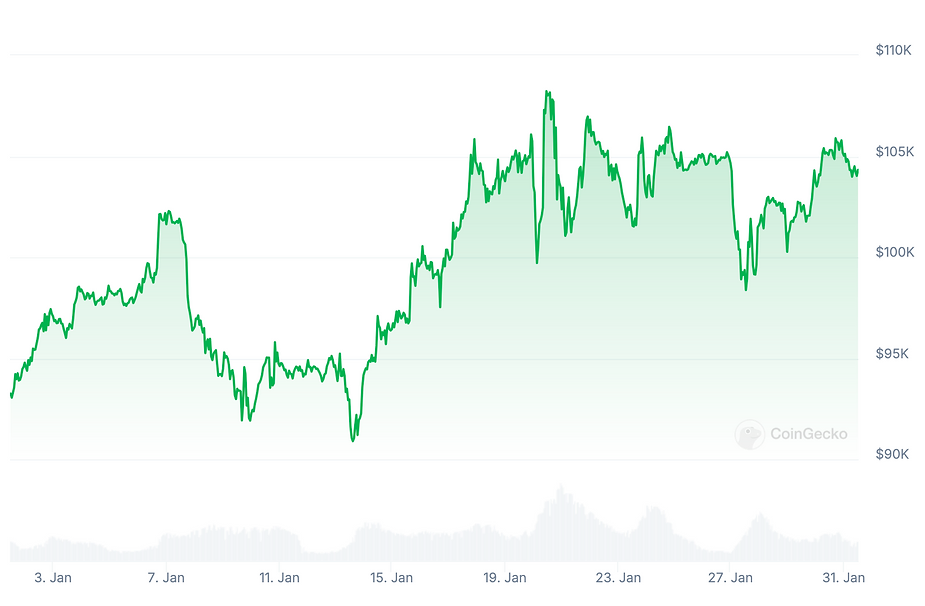

Currently, as of January 30, 2025, the price of Bitcoin is approximately $105,236, with an intra-day high of $105,581 and a low of $101,423. This continued rise reflects the growing interest and confidence that investors have in this cryptocurrency. You can check bitcoin prices in real time at https://bitcoinprice.ro/

bitcoin (BTC) price evolution in January 2025, source https://www.coingecko.com/[/caption]

bitcoin (BTC) price evolution in January 2025, source https://www.coingecko.com/[/caption]

How does bitcoin work?

1. Transactions are verified by users called miners, who solve complex math problems to add new blocks to the blockchain.

2. Rewards for miners come in the form of new Bitcoin generated and transaction fees.

3. Users can send and receive Bitcoin using digital wallets.

Why is Bitcoin important?

✔ It paved the way for the development of other cryptocurrencies.

✔ It is considered “digital gold” because it allows long-term storage of value.

What factors influence the value of bitcoin

The factors influencing the value of bitcoin are diverse and include the existing supply/demand ratio in the market, global economic and political events, technological developments and changes in legislation. Also, an important role is played by investor sentiment, as bitcoin is often perceived as a safe-haven asset in times of economic uncertainty.

1.Supply and demand – the ratio between the maximum number of coins available and people’s willingness to buy them is an important factor influencing the value of bitcoin. The total supply is limited to just 21 million coins. As a consequence, the value of Bitcoin may increase as demand increases.

2.Institutional adoption and the emergence of new financial products – as Bitcoin becomes an increasingly widely used financial instrument by investors and financial institutions to store value and generate profit, derivatives such as exchange traded funds (ETFs) and futures contracts are beginning to develop, resulting in traditional investors having easier access to digital assets.

3. Global government regulations – Global economic events such as the financial crises and the Covid-19 pandemic have also influenced the evolution of bitcoin’s value. In times of economic uncertainty, investors seek alternatives to conventional financial assets. As a result, there is an increase in demand for bitcoin and hence an increase in its value.

For example, decisions by the Chinese and Indian governments to restrict or ban cryptocurrency trading have resulted in significant price declines.

How Bitcoin positions itself in the cryptocurrency market

Since Bitcoin’s emergence on the cryptocurrency market and to date, thousands and thousands of other cryptocurrencies have been launched, each with different functions and purposes.

Ether (ETH), for example, is a token used in the Ethereum network, an open-source platform for smart contracts and decentralized applications (dApps). This means that, in addition to financial transactions, Ethereum enables the issuance of entirely new cryptocurrency assets, known in the cryptocurrency market as ERC-20 tokens.

Ripple (XRP) is a cryptocurrency founded in 2012 by Ripple Labs. It has a global decentralized network of over 150 validators and was created to facilitate exchange between different currencies. Generally, a financial transaction involving currency exchange can take up to several days. But Ripple claims that it can do it, thanks to modern technology on its blockchain, in 3 to 5 seconds.

Litecoin (LTC) is another cryptocurrency developed with the aim of offering the fastest and cheapest transactions. The coin is based on the source code of Bitcoin and is very suitable for everyday transactions. It uses a proof-of-work (PoW ) mechanism, but the algorithms used to validate the blocks are different from those used by Bitcoin. Litecoin uses an algorithm called Scrypt which allows blocks to be generated in a much shorter time than the algorithm used by Bitcoin (Secure Has).

Cardano, a ‘third generation’ blockchain, aims to solve the scalability problems faced by ‘generation one’ (Bitcoin) and ‘generation two’ (Ethereum) blockchains. Its cryptocurrency, ADA, is one of the best-known and most popular coins, named by Charles Hoskinson, founder of the Cardano blockchain, after 19th century mathematician Ada Lovelace.

Polkadot (with cryptocurrency DOT) is a relatively new project in the cryptocurrency market, launched in May 2020 in order to facilitate interoperability between different blockchains. The mechanism under which it works is known as proof-of-authority ( PoA). Polkadot enables the exchange of information and assets between different blockchains, basically allowing specialized blockchains to connect into a single interconnected network.

Chainlink (with the LINK cryptocurrency) aims to connect smart contracts with external real-world data sources and is designed as a “decentralized oracle network”. The aim is to take smart contracts to the next level by enabling access to data in real time but with the security and transparency of blockchain technology.

Evolving trends in the cryptocurrency market

Here are some of the most important evolving trends in the cryptocurrency market:

1. Tokenization of physical assets

“Tokenization” is a process of transforming real assets (such as various commodities, real estate, stocks, etc.) into digital assets so that they can be traded securely and without the need for third-party intervention on the blockchain.

Basically, a user can own the ownership of physical assets in a digitized form. This tokenization process is actively supported by legal regulations issued by specific authorities. The Securities and Exchange Commission (SEC) , for example, has released a document to the market that defines digital activity and the guidelines that issuers and investors must heed.

2. Growing adoption of stablecoins

Stablecoins, also known as stablecoins, are those currencies whose value is strictly linked to an asset class. There are several types of stablecoins: those backed by fiat currencies, cryptocurrencies or commodities. Stablecoins are becoming increasingly popular in international transactions and payments precisely because of their stability and their adoption rate is currently increasing.

3. De-Fi and NFT technologies are increasingly widely deployed

Decentralized finance (De-Fi) and non-fungible tokens (NFT) are becoming part of increasingly complex ecosystems.

Broadly speaking, to define the concept of “decentralized finance” we could say that almost any smart contract running on a blockchain is a De-Fi application. These apps are designed to perform transactions typically intermediated by banks. However, they eliminate the middleman (the bank) and thus provide more flexibility, control and speed to transactions.

Non-fungible tokens (NFTs) are a major innovation in the cryptocurrency market. NFTs are unique, value-bearing digital assets that can represent anything from works of art to various limited-edition collections. They are mainly used as a way to sell valuable and exclusive items online.

4. Growing interest in green cryptocurrencies

More and more cryptocurrencies are tending to use environmentally sustainable technologies to reduce the carbon footprint of the mining process. The best example is ADA (Cardano). The Cardano platform uses a consensus method called proof-of-stake (PoS), a mechanism with incomparably lower energy consumption than the one known as proof-of-work (PoW) currently used by most blockchains.

Conclusion

Because of its potential to fundamentally change the way we manage and transfer value, the cryptocurrency market is a growth area. It continues to attract both investors and technology enthusiasts. Regardless of future developments, Bitcoin will continue to be a focal point in the cryptocurrency ecosystem, influencing market trends and adapting to new emerging technologies.