When it comes to investing your savings in income-generating assets, you can choose between two popular options: investing on the stock market or investing in cryptocurrencies. Both offer attractive earning potential, but also commensurate risks. So which one is right for you? In this article, we’ll explain what each option consists of, its advantages, risks, and make a direct comparison to help you make the right decision.

Thinking of buying or selling cryptocurrencies, but don’t know which exchange to choose? With Abarai, you can buy cryptocurrencies using multiple payment methods, you can instantly swap between different cryptocurrencies and, most importantly, you are the only one in full control of your funds. Abarai is the only platform in Romania that offers support in Romanian.

Principalele piete de investitii

The main investment markets fall into several categories, each with specific characteristics and risks:

Stock market (shares):

- This is where shares in publicly listed companies are traded.

- Investors become part-owners of companies and can benefit from dividends and share value growth.

- It is a market with high return potential, but also with significant risks.

Bond market:

- It trades bonds issued by governments, companies or other entities.

- Investors lend money to issuers and receive interest.

- It’s considered safer than the stock market, but with generally lower returns.

The real estate market:

- Includes investments in residential, commercial or industrial property.

- It can generate rental income and increase property values.

- It requires significant capital and is less liquid than other markets.

Raw materials market:

- It trades commodities such as gold, oil, grains or precious metals.

- Their value is influenced by global economic factors and supply and demand.

- It can be volatile and requires specialized knowledge.

Cryptocurrency market:

- A relatively new market trading digital assets such as bitcoin and Ethereum.

- It is highly volatile, with the potential for high returns but also considerable risks.

Foreign exchange (Forex):

- This is where the currencies of different countries are traded.

- It’s the most liquid market in the world, but also highly volatile.

It’s important to remember that each market has its own risks and opportunities, and investment diversification is essential to manage risk.

Investing on the stock exchange. Benefits and risks

Stock market investing involves buying shares in publicly listed companies. These shares basically make you a ‘part-owner’ of that company. The value of these stock market investments can go up or down depending on the company’s performance and general economic market conditions.

Ce este bursa și cum funcționează?

An exchange is a mechanism that facilitates the buying and selling of stocks, bonds and other financial instruments in an organized way. For example, shares in a company give you part ownership of that company, while bonds are loans issued by companies or governments. In short, exchanges connect investors who want to buy (trade) with those who want to sell.

Beneficiile unei investiții la bursă

- Long-term capital growth. Good stocks can show steady increases over the years. Although the stock market can fluctuate, history shows that most stock market investments tend to grow over time. This means today’s investments could be more valuable 10, 20 or 30 years from now.

- Generating passive income: Investing in the stock market involves buying shares in publicly listed companies. These shares entitle you to receive annual dividends from the company.

Investiții la bursă și riscurile asociate

- Volatility: Stock markets can be unpredictable in the short term and share values can fluctuate drastically due to economic or geopolitical news. If you want to invest in the stock market then think long-term and don’t make impulsive decisions based on momentary emotions.

- Financial education: It is necessary to have a minimal understanding of the market to make wise stock market investments. Education is the key. Study, watch online courses and check out free materials available on the Abarai Academy platform.

- Lack of portfolio diversification can lead to loss:Investing all your capital in one company or industry increases risk. If that company or industry suffers, your entire portfolio can be affected.

Investitii criptomonede. Beneficii si riscuri

Cryptocurrencies are digital assets that can be used for financial transactions, store of value, utility tokens, investment instruments and more. Most cryptocurrencies use blockchain technology and their security is based on complex cryptographic algorithms.

Benefits of investing in cryptocurrencies

Potential for significant capital growth

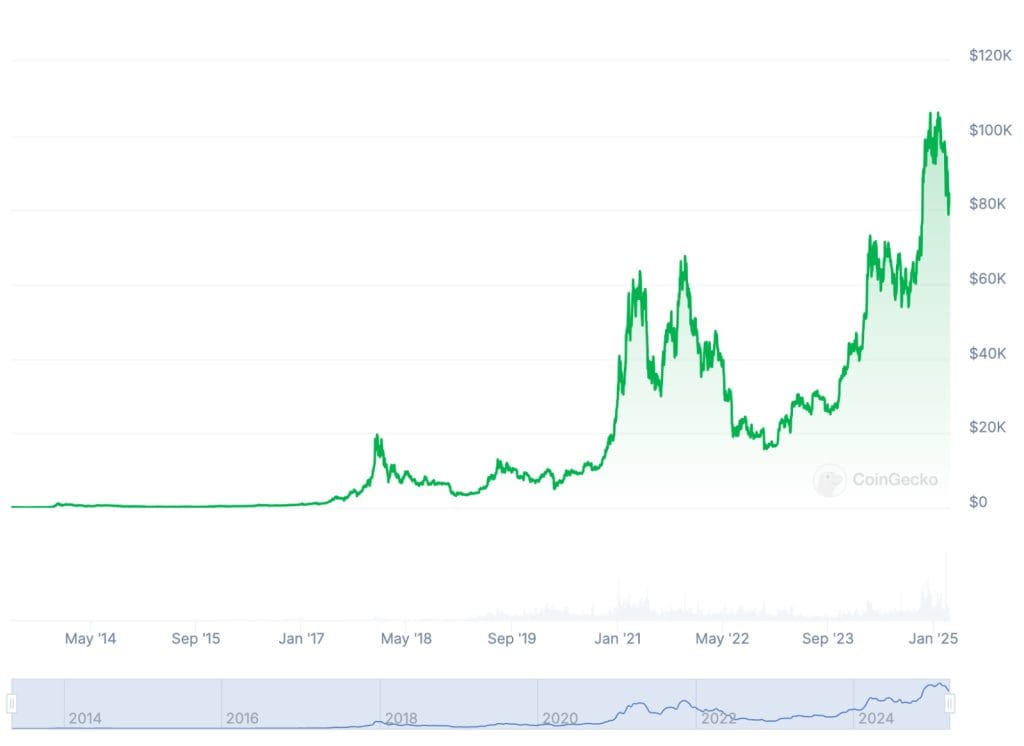

One of the most appealing features of cryptocurrencies is their potential for exponential growth. In recent years, there have been meteoric increases in the value of some cryptocurrencies. Bitcoin, for example, has risen from pennies in 2009 to tens of thousands of dollars per unit. This means early investors have managed to make staggering gains.

Why is this potential worth considering?

- Market volatility can create short- and long-term opportunities for investors. While price fluctuations may seem risky, they also allow for significant profits.

- The growing adoption of cryptocurrencies by well-known companies and financial institutions (such as Tesla or Visa) is increasing their credibility and popularity, leading to their rising value.

Diversifying your investment portfolio

Investing in cryptocurrencies provides essential diversification for your portfolio, reducing the risks associated with other asset classes such as equities or real estate.

Diversification benefits:

- Resilience to economic turmoil: Cryptocurrencies operate independently of traditional economies, meaning they are not directly influenced by inflation, financial crises or the devaluation of national currencies.

- Improved long-term portfolio performance, as even a small allocation in digital assets can have a major impact on total return.

Access to cutting-edge innovation and technology

Cryptocurrency investing allows you to be part of a technological revolution. The blockchain technology underpinning cryptocurrencies promises to transform entire industries, from banking and logistics to healthcare and energy.

What does the technology bring?

- Full transparency and secure transactions thanks to blockchain technology.

- Decentralization that eliminates traditional intermediaries (like banks).

- New economic opportunities such as smart contracts used in various digital applications.

Global accessibility

Another important characteristic of cryptocurrencies is their global accessibility and the fact that digital asset markets are open 24/7. Compared to traditional markets such as stock exchanges, cryptocurrencies can be bought, sold or traded at any time of the day or night.

How does this help?

- Fast and accessible transactions: You can buy and sell cryptocurrencies directly from your phone or laptop, at any time of the day or night, without complicated formalities.

- No geographical barriers: No matter where you are, you can trade cryptocurrencies.

Potential to generate passive income

In addition to the gains from price appreciation, cryptocurrencies also allow the generation of passive income, providing those who wish to invest in cryptocurrencies with a valuable source of supplementary income.

Popular options for passive income

- Staking: Some cryptocurrencies (such as Ethereum 2.0, Polkadot or Cardano) offer rewards for blocking and validating transactions.

- Yield farming: You can use your cryptocurrencies on DeFi (decentralized finance) platforms to earn interest.

- Lending crypto: You can lend your cryptocurrencies to other users through secure lending platforms and earn interest.

Risks of investing in cryptocurrencies

Investing in cryptocurrencies is attractive to many because of the potential for quick returns and the ability to access a decentralized market. However, they come with a significant set of risks that should not be ignored.

Extreme volatility

Cryptocurrency prices can fluctuate dramatically in a short space of time, rising significantly one day and falling alarmingly the next.

For example, the bitcoin price has had moments where it rose by over USD 1,000 in one day and then lost a considerable portion of its value in just a few hours. Thus, on June 26, 2019 Bitcoin opened the market at around 11,732 USD and closed at 13,976 USD, marking an increase of over 2,200 USD in a single day. However, the following day brought a drastic drop of USD 3,442, with the price closing at USD 10,534. This kind of volatility can lead to considerable financial losses if investments in cryptocurrencies are not made without a well-thought-out strategy.

How to reduce risk:

- Only invest amounts you can afford to lose.

- Diversify your portfolio to lessen the impact of fluctuations.

- Avoid emotional decisions and rely on data and analysis.

Security risks

Cryptocurrencies are, by their nature, digital, which paves the way for various security risks. Hackers are constantly looking for ways to exploit vulnerabilities in cryptocurrency exchange platforms and digital wallets.

Examples of common risks:

- Loss of digital wallet access due to forgotten passwords.

- Cyber attacks on exchange platforms. In 2014, for example, Mt. Gox, a cryptocurrency exchange platform, lost $450 million worth of bitcoin to a cyber attack.

- Phishing or other forms of fraud where users are tricked into providing sensitive information.

We recommend reading the article “Hackers stole $1.5 billion. Bybit cryptocurrency heist”

How to reduce your risk:

- Use a hardware or offline wallet to store cryptocurrencies.

- Enable two-step authentication (2FA) for all your cryptocurrency-related accounts.

- Avoid keeping large amounts on exchange platforms.

Lack of liquidity

Although many cryptocurrencies are widely traded, not all of them have sufficient liquidity. Low liquidity can make it difficult to sell assets at competitive prices, especially in unstable markets.

What does this problem look like?

- Lesser-known cryptocurrencies can have very low trading volumes, meaning you may not find a buyer when you want to sell.

- Increased impact of large orders on the price, which can lead to losses.

How to mitigate the risks of illiquidity:

- Invest in popular cryptocurrencies with high trading volume.

- Check liquidity before investing in a less popular cryptocurrency.

- Keep a balance between long-term and short-term investments.

Why we do NOT recommend investing in meme coins or untraded virtual coins

Cryptocurrencies continue to gain popularity globally, and investors are often tempted by the quick success stories or hype generated by certain virtual currencies. In particular, meme coins and uncodenominated coins appear to be get-rich-quick solutions for many. But these investments come with significant risks that cannot be ignored.

What are meme coins and virtual coins?

Meme coins are cryptocurrencies created based on famous memes on the internet or as a joke. They are heavily promoted on social networks and often go viral in a short time. Famous examples include Dogecoin and Shiba Inu.

Unacquired virtual currencies, on the other hand, are those new or lesser-known cryptocurrencies that have no clear practical use, strong community or advanced technology.

Both categories are highly speculative and based more on hype than real value.

What makes them popular?

- Affordability: It often costs little to buy these coins, attracting investors who want to “try out” the cryptocurrency market.

- Social Media Hype: Celebrity influencers and online communities aggressively promote these coins, fueling the phenomenon of “Fear of Missing Out” (FOMO).

- The promise of quick wins: Many are lured by the idea of making major profits in a short time.

Why is investing in meme coins a major risk?

Investing in these coins comes with a multitude of significant drawbacks that you need to be aware of.

- Meme coins and uncoined coins often lack a concrete purpose or useful technology. Unlike established cryptocurrencies like Bitcoin or Ethereum, they offer no real value or long-term sustainability.

- Prices can fluctuate massively in a short period of time. A currency can rise 1000% one day, only to lose 90% of its value the next. This instability makes it impossible to predict long-term outcomes.

- Many of these currencies are the target of pump-and-dump schemes. In such cases, a group of investors artificially increases the value of a currency, only to sell en masse, leaving other investors with significant losses.

We recommend you read the article “Cryptocurrency scam launched by Donald J Trump? $Trump a big scam?”

Stock market investing vs cryptocurrency investing

Let’s further analyze the differences and similarities between these two options, evaluating the key aspects for each.

Volatility

- The stock market shows fewer fluctuations than the crypto market. However, it is influenced by macroeconomic and geopolitical factors that can cause significant short-term changes.

- Cryptocurrencies are extremely volatile. Daily fluctuations can even reach 20%-30%, making crypto investments riskier in the short term.

Earning potential

- Investing in the stock market can generate steady gains and dividend income over the long term, but the annual percentage growth is often more limited compared to cryptocurrencies.

- Cryptocurrencies, by contrast, have seen spectacular increases for some investors. For example, Bitcoin has risen in 10 years from a few dollars to tens of thousands of dollars per unit.

Accessibility

- The stock market sometimes requires more complex procedures to open a trading account, especially for novice investors.

- Cryptocurrencies are very accessible. Platforms like Abarai make buying cryptocurrencies quick and easy, eliminating complicated bureaucratic steps.

Regulation and safety

- The exchange is well regulated, which provides a clear safety framework for investors.

- The crypto market is constantly evolving and regulations are gradually adapting to this dynamic. While important steps have been made towards regulation, certain aspects may still remain unregulated in some jurisdictions, implying additional risks for investors. A case in point is the lawsuit between the SEC and Ripple(XRP), which highlights the complexity of the classification of certain cryptocurrencies and the potential impact of regulators’ decisions.

Who wins? It depends on your priorities:

- If you prefer lower risk, steady gains and a regulated environment, investing in the stock market is a solid choice.

- If you have a higher risk tolerance and want to benefit from the high earning potential, investing in cryptocurrencies might be right for you.

What really matters is investing in an informed way and not allocating more capital than you can afford to lose.

Conclusions

Whether you choose to invest in the stock market or cryptocurrencies, the first step is to understand the market and make informed decisions. If you have questions or feel ready to get started, consider secure platforms like Abarai for buying cryptocurrencies or consult a broker for stock market investing.