In the world of cryptocurrencies and blockchain technology, Algorand is a platform that has quickly earned its place in the spotlight. Created with the goal of solving the fundamental challenges of blockchain, Algorand promises to be the solution that combines scalability, security and decentralization. In this article, you’ll learn what Algorand is, how the network works, the history and price evolution of the network’s native token, and why Algorand could be a good choice for your investment portfolio.

If you’re an investor interested in adding ALGO to your cryptocurrency portfolio, you can purchase the currency via swap on the Abarai platform. Here’s why Abarai is the number one choice of investors in Romania:

- Abarai is at your disposal with a state-of-the-art intuitive interface that helps every user to exchange cryptocurrencies quickly, cheaply and securely.

- Abarai offers the best prices: you can trade any amount of cryptocurrency at the best rates.

- The Abarai platform is the only one in Romania that offers support in Romanian.

What is Algorand: Advantages of an advanced blockchain network

In order to fully understand the potential of Algorand, it is essential to first see what this platform is and for what purpose it was created.

What is Algorand

Algorand is a next-generation blockchain technology designed to be energy efficient, fast and affordable. Algorand uses an innovative consensus mechanism, called Pure Proof-of-Stake (PPoS), which guarantees network security and absolute transparency.

Launched in 2019, the Algorand network was created by Professor Silvio Micali, a renowned cryptographer and winner of the Turing Prize, the equivalent of the Nobel Prize in computer science. His goal? To create a blockchain that works without the shortcomings found in traditional solutions, such as slow speed, high cost and negative environmental impact.

Algorand’s use cases clearly demonstrate its value. For example:

- Folks Finance uses Algorand for the most advanced DeFi protocols.

- LabTrace uses the network to authenticate and verify medical and academic data.

- Wholechain enables companies to collect verifiable supply chain data.

Advantages of the Algorand platform

If you’ve been wondering what Algorand is and what makes it unique, here are its main advantages:

Scalability

One of the biggest challenges for blockchain technology is the ability to handle a large volume of transactions without compromising performance. Algorand successfully solves this problem because it can process up to 10,000 transactions per second (TPS). This makes it useful for applications that have millions of users, such as financial systems or supply chains.

Quick completion of transactions

Another unique feature of Algorand is its instant finality(Atomic Transfers). Compared to other blockchain networks, where confirmation of a transaction can take minutes or even hours, Algorand offers immediate execution, without the risk of rollback or uncertainty.

Increased security thanks to the consensus mechanism used

To guarantee data security and transaction integrity, Algorand uses a unique mechanism in the blockchain world, Pure Proof of Stake (PPoS). PPoS is designed to be resistant to various types of attacks, including 51% attacks (where an attacker controls the majority of the computing power or stake).

Energy efficiency superior to other blockchain networks

Unlike Proof-of-Work (PoW) blockchains, which consume huge amounts of energy through mining, Algorand uses the PPoS mechanism, which requires significantly less energy consumption. Thus, Algorand positions itself as a “green” blockchain that complies with sustainability standards and organizations implementing this technology can improve internal processes without compromising the environment.

If you are interested in learning more, you can read the Algorand Whitepaper here.

How the Algorand blockchain works

Algorand has introduced a radical change in the way blockchain networks validate transactions and reach consensus by implementing two innovative technologies: Pure Proof-of-Stake (PPoS) and Algorand Virtual Machine (AVM). Pure Proof-of-Stake (PPoS) is one of the most advanced and revolutionary methods for validating and securing transactions on blockchain, while Algorand Virtual Machine (AVM) opens new horizons for the development of smart contracts and decentralized applications. All in all, Algorand gives you all the tools you need directly on the main network (layer 1).

What is Pure Proof-of-Stake (PPoS)?

The Algorand blockchain has introduced a revolutionary concept called Pure Proof-of-Stake (PPoS), an advanced consensus mechanism that solves many of the limitations of other blockchains. Unlike traditional Proof-of-Stake (PoS), where users have to “lock” their tokens to contribute to the consensus, in PPoS tokens remain in the user’s wallet, providing more flexibility and control.

The PPoS system works on three key principles

- Random selection of validators The Algorand network uses Verifiable Random Functions (VRF) and advanced cryptography to select validators in a completely random and secure way. In each block, a cryptographic selection of block proposers and validator committee is performed.

- Security against attacks Because the validators are chosen randomly and only for one use per block, cyber attacks, such as distributed DDoS attacks, are rendered useless to execute.

- Unification and decentralization The decentralization of the platform is ensured by the fact that anyone can participate in the validation of transactions, regardless of the number of coins held.

Examples of PPoS usage

- Decentralized fund management PPoS allows companies to maintain funds distributed across the entire Algorand network without fear that they could be “locked” in staking processes. At the same time, transactions are securely validated.

- Real-time transactions Designed to run thousands of transactions per second(~10,000), Algorand is an ideal option for instant payments with minimal costs, for example in financial or e-commerce applications.

What is Algorand Virtual Machine (AVM)

AVM (Algorand Virtual Machine) is a secure execution environment, distributed across the entire Algorand network and running on every node. Specifically, AVM plays a crucial role in the evaluation and execution of smart contracts and smart signatures.

AVM is important for the future of blockchain applications because it allows developers to:

- Run complex applications directly on layer-1 for various domains such as finance, gaming or DeFi protocols.

- Provides a significant computational budget, especially needed for scalable applications.

- Access Algorand’s fast, secure and low-cost blockchain systems.

Key features:

- Stateful and stateless smart contracts enabling flexible scheduling and high applicability.

- Dynamic memory allocation for complex applications and scalable storage.

- Direct integrations with other layer-1 system functions such as atomic transfers and Algorand standardized assets.

How can AVM be used?

AVM finds applicability in several areas of blockchain development, including, but not limited to:

Smart contracts for maximum efficiency

Stateless smart contracts work on the basis of transacted data without using state from the ledger, making them ideal for:

- Cryptographic operations.

- Payment channels and escrows.

- Atomic transfers and tax delegations.

On the other hand, stateful smart contracts, which add the possibility to store and manage data directly on-chain, find their usefulness in:

- Creating decentralized marketplaces.

- Supply chain management.

- Gaming and loyalty through customized programs.

Financial applications and Defi

Thanks to low transaction costs and fast execution, AVM facilitates the development of Automated Marketplaces (AMMs), instant transfers and complex financial contracts directly on the blockchain.

Smart contracts on Algorand

Smart accounts are programs that run on blockchains and automatically execute predefined actions when specified conditions are met. They eliminate the need for intermediaries, reduce risk and bring more efficiency and transparency to processes. In Algorand’s case, AVM is the engine that enables the running of smart contacts. Algorand uses two distinct types of smart contacts:

- Stateless Smart Contracts

- Stateful Smart Contracts (applications)

Stateless smart contracts on Algorand

Stateless smart contracts, also known as smart signatures, are deterministic programs (for the same inputs, the contract will always produce the same output) that do not interact with the state of the blockchain. This means that their checks and conditions are based solely on the data included in the transaction, without depending on other factors.

Key features:

- It does not store or access blockchain information.

- They are evaluated as “true” or “false” regardless of the blockchain state.

- They can be used for cryptographic operations, tax delegation, atomic transfers, payment channels and escrow services.

Practical uses:

- Atomic Transfers: Allows a set of transactions to be executed simultaneously or completely invalidated if one fails.

- Escrow services: Funds can be placed in a contract that is only released once the pre-defined conditions are met.

- Fee Delegation: Allows one party to bear transaction fees on behalf of another.

This type of smart contract is ideal when simplicity and efficiency are priorities.

Stateful smart contracts on Algorand

Unlike Stateless, Stateful smart contracts store and manage data directly on the blockchain. They allow information to be tracked and manage the state of the contract, which can change based on user interactions or previously defined logic.

Key features:

- Stores data such as user balances, game scores and ownership records.

- Contract status is dynamic and can be updated based on interactions.

- Requires more resources than Stateless contracts, but offers greater customization power.

Practical uses:

- Decentralized marketplaces: Transaction record keeping and automated bid and offer management.

- Loyalty programs: tracking points earned by customers and applying rewards.

- Games: Tracking scores and player progress.

- Asset tokenization: Generating and managing real-world assets (e.g. real estate, art) in the form of tokens.

Stateful Smart Contracts bring complexity and flexibility, allowing developers to create more advanced solutions.

Algorand Standard Assets (ASA)

Algorand Standard Assets (ASA) are a key functionality of the Algorand blockchain that allows for simple and efficient creation and management of digital assets directly on layer 1 of the blockchain. Here are some key aspects of Algorand Standard Assets (ASA):

Standardizing the framework for creating and managing digital assets

ASA provides a standardized framework for creating and managing digital assets. This standardization is essential to ensure interoperability between different platforms and applications. The benefits of standardization are:

- Increased compatibility between different applications, facilitating interoperability.

- Provides a clear and simple process for creating digital assets.

- Reduces human or technical errors thanks to well-defined rules.

With ASA, both experienced developers and non-technical users can create digital assets without significant barriers.

Scalability and almost instant confirmation of transactions

- High scalability – Algorand can process thousands of transactions per second, regardless of transaction volume.

- Quick time stamps ensure almost instant confirmation of transactions.

- Low operating costs, making ASA attractive for widespread adoption.

For example, transferring an ASA is as fast as sending a native digital currency on the Algorand blockchain, making assets highly efficient for end users.

Increased security

- It uses advanced cryptography to protect your assets.

- Eliminate the risks associated with additional smart contracts as ASAs are natively integrated into the Algorand system.

- The Algorand blockchain is protected against attacks thanks to its unique PPoS mechanism.

Types of assets that can be created with ASA

A. F fungible tokens – Stablecoins, loyalty points or other assets that can be traded equally.

B. Non-fungible tokens (NFTs ) – Which represent unique assets such as:

- Digital collectibles.

- Digital art.

- Videos or audio recordings.

C. Representing real-world assets – Such as:

- Stocks, bonds.

- Real estate, intellectual property rights.

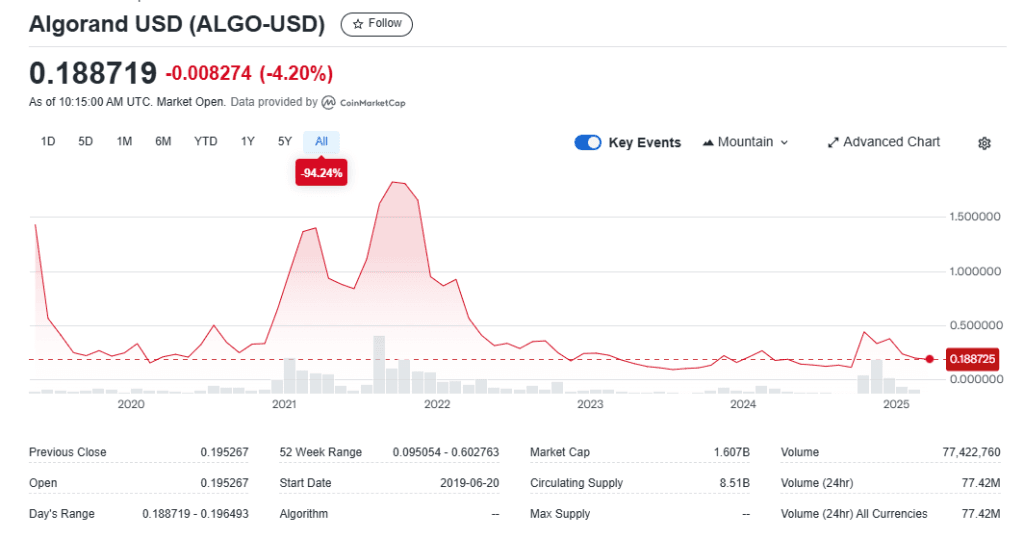

ALGO price history and evolution

ALGO is Algorand’s native network token, used for transaction fees, staking and participation in network governance.

Price evolution ALGO

1. 2019 – Launch and initial price drop

ALGO was launched in 2019 with an initial price of USD 0.24 in the Initial Coin Offering (ICO). However, upon debut on the exchange, the coin hit an impressive high of USD 3.44.

After this spectacular start, the price of ALGO fell rapidly. By September 2019, the price had lost a significant part of its value, influenced by massive early investor withdrawals and general uncertainty in the cryptocurrency market.

2. 2019-2020 – Low stabilization

After the initial dip between October 2019 and December 2020, ALGO entered a period of consolidation. The price stabilized, with relatively limited fluctuations between USD 0.13 and USD 0.52.

This period has been characterized by low activity in the overall cryptocurrency market as investors waited for a global economic recovery and regulatory clarity for digital assets.

3. 2021 – ALGO price explosion

In 2021, cryptocurrencies entered a period of accelerated growth, and ALGO was no exception. In January 2021, the price started to rise, peaking at $1.79 in April 2021.

After a temporary dip in May-July 2021, the price of ALGO has been on an upward trend again, peaking at USD 2.99 in November, almost matching its all-time high since its launch in 2019.

This growth has been supported by the growing demand for efficient blockchain platforms, strategic partnerships and the recognition of Algorand’s technology as one of the most promising Web3 solutions.

4. 2022 – present – Corrections and stabilization

Since November 2021, ALGO has again entered a downtrend, reflecting a complicated macroeconomic landscape, including global inflation and rising interest rates.

Currently, according to data provided by CoinGecko as of March 2024, the price of ALGO has stabilized around USD 0.19, in line with the cryptocurrency market trends in general.

CoinGeckodates (March 21, 2024):

- Market Cap: 1,632,217,050 USD

- Fully Diluted Valuation: 1,632,261,666 USD

- 24 Hour Trading Vol: 75,652,099 USD

- Circulating Supply: 8,514,680,116 ALGO

- Total Supply: 8,514,912,857 ALGO

- Max Supply: 10,000,000,000,000 ALGO

How might the price of ALGO evolve in the future?

While it is impossible to accurately predict the price evolution for ALGO, the outlook remains promising, especially given the growing focus on sustainable solutions in blockchain, and Algorand’s performance in this direction is notable.

Users who believe in the long-term vision of the network and its ability to overcome current challenges might consider this an opportune time to accumulate. However, it is always advisable to do your own research and analyze the risks before investing.

Final conclusions

Algorand offers a unique combination of advanced technology, energy efficiency and fast transaction completion. These features make it attractive to companies, institutions and investors. As the Algorand ecosystem develops and is widely adopted, ALGO has the potential to become a valuable asset.

However, the crypto market is extremely volatile and investing involves significant risks. Invest only the amounts you can afford to lose and stay informed with the latest news and educational articles from the Abarai blog.

Recommended articles: