Is ETH a smart investment for 2025? How will the price of Ethereum (ETH price) evolve in the coming months? If you’re thinking “which cryptocurrency to buy in 2025”, this article will give you the reasons why Ethereum could be a worthy option to consider.

To purchase ETH or any other cryptocurrency, the Abarai platform is at your disposal with a simple and intuitive interface. Here are some reasons why you can choose Abarai:

- Low and transparent exchange fees. There are no hidden fees to diminish your profit.

- Anonymity: for swap transactions you enjoy complete anonymity and instant transactions.

- No account opening and complicated registration procedures: for transactions under 5000 Ron you don’t need to open an account, just provide your billing details

- You have complete control over your funds: the Abarai platform is a non-custodial exchange, so it won’t store your funds.You say where you want your cryptocurrency to be sent and the money goes there.

What is Ethereum (ETH). performance ETH price

Ethereum is a blockchain network that introduced the concept of smart contracts, or smart contracts. This technology enables the running of decentralized applications (dApps), making Ethereum a pioneer in areas such as decentralized finance (DeFi), NFTs, and other blockchain-based sectors. Unlike other cryptocurrencies focused solely on financial transactions, such as Bitcoin, Ethereum provides users with a perfect platform for innovation and growth.

Ethereum (ETH) performance in recent years

Ethereum has stood out as a leader in the cryptocurrency market thanks to its consistent performance and technological evolution. Here are some highlights from the past few years:

- Notable price growth: In the time since its launch in 2015, ETH has seen spectacular growth, evolving from an initial price of around 31 cents to an all-time high of $4871 in January 2021.

- Massive adoption: Ethereum is the underlying platform for thousands of tokens and blockchain projects. Most NFTs and DeFi platforms are built on Ethereum.

- Transition to a more sustainable future: The completion of the Ethereum 2.0 upgrade, known as The Merge, moved the Ethereum network from Proof of Work (PoW) to Proof of Stake (PoS), greatly reducing power consumption.

These factors indicate a strong track record of growth and solid positioning for the future.

Ethereum (ETH): Key milestones

While Bitcoin was created to function as a digital currency, Ethereum opened the door to a complex ecosystem of decentralized solutions. Over time, Ethereum has gone through important changes that have influenced both its adoption rate and price.

There are three key moments that define the evolution of Ethereum:

- The launch of Ethereum 2.0 (“The Merge”) and the transition to Proof of Stake (PoS).

- Increasing adoption of Layer 2 solutions.

- Network scalability challenges.

Ethereum 2.0 (“The Merge”): Transition to Proof of Stake

One of the most important moments for Ethereum was the launch of Ethereum 2.0, also known as “The Merge.” It marked a major transition from the Proof of Work (PoW) mechanism to Proof of Stake (PoS). Unlike PoW, where miners must solve complex problems to validate transactions, PoS allows users to lock a certain number of ETH coins (an operation called “staking”) to secure the network and validate transactions.

Benefits for the network and investors:

- Reduced energy consumption: with the move to PoS, the network’s energy consumption has significantly decreased. This makes Ethereum more sustainable and more attractive to investors concerned about environmental impact.

- Improved scalability: Ethereum 2.0 paves the way for shard chains, which will distribute the load across multiple chains and greatly increase transaction speeds.

Layer 2 solutions

What are Layer 2 solutions?

As Ethereum adoption has grown, network congestion has led to increased transaction fees and processing times. Layer 2 solutions, like Arbitrum, were developed to address these issues by processing transactions outside of the main blockchain (Layer 1). Their main goal is to increase the scalability of Ethereum, i.e. to allow processing a much larger number of transactions at a lower cost and higher speed, without compromising the security provided by Layer 1.

How does Layer 2 work?

Layer 2 solutions achieve this through various “off-chain computation” techniques. Essentially, much of the transaction processing takes place on a separate network (Layer 2), and then the results of these transactions are “rolled” or “anchored” back to the main Ethereum blockchain. This significantly reduces the load on Layer 1.

Advantages of Layer 2 solutions:

- Reduced transaction fees: users pay lower fees, which influences an increase in the number of transactions and adoption rate.

- Increased transaction speed: The time required to validate transactions is significantly reduced.

- Develop the dApps ecosystem: These solutions enable developers to create more efficient and user-friendly applications.

A case in point is Arbitrum, which has attracted a large number of DeFi platforms due to its low cost and high performance. Arbitrum is one of the most popular Layer 2 solutions and uses a specific technology called Optimistic Rollups whereby users interact with decentralized applications (dApps) directly on the Arbitrum network. Transactions are batched and data is published on the Ethereum main blockchain.

Increasing the scalability of the Ethereum network could positively influence the price of ETH in the future through several mechanisms, although the exact impact is complex and depends on various factors.

ETH Price: On-Chain Analysis

On-chain analysis is an essential method to understand Ethereum network trends and their impact on the ETH price. It consists of examining and interpreting data from a blockchain, data that includes information about transaction volume, network activity, staking activity, and other activities taking place on the network.

Network activity and transaction volume

The number of active addresses and the volume of transactions in the network provide clear clues about the popularity and use of ETH. If activity increases significantly, it may suggest wider adoption, thereby increasing trust in the network and the price of the currency.

Ethereum (ETH) Network Activity

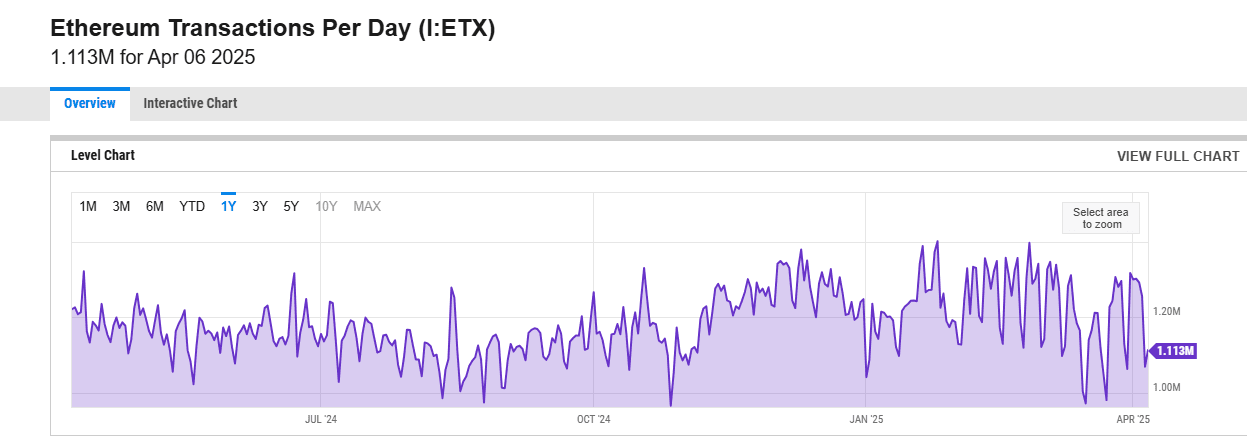

- Number of Daily Transactions

The average daily number of transactions is a leading indicator of network activity. Significant increases may signal increased usage, while decreases may suggest a lack of interest from users.

- According to data as of April 6, 2025 (YCharts), the Ethereum network recorded approximately 1.113 million transactions per day. This figure suggests stable activity with no recent spikes or massive drops. https://ycharts.com/indicators/ethereum_transactions_per_day

- Number of Daily Active Addresses

Active addresses represent the number of unique participants interacting with the network (sending or receiving ETH).

- As of April 7, 2025 (Binance Square), 335,800 daily active addresses indicates stagnant user activity. This reflects a stable environment rather than rapid expansion.

- Network Utilization

This indicator measures how “busy” the network is in relation to its total capacity.

According to YCharts, current network utilization is 50.96%, below the long-term average. This may be an opportunity for lower charges or an indication of lower activity.

- Gas Fees

Ethereum fees fluctuate depending on the demand for the block space. Low fees may be appealing to users, but may suggest lower activity. If fees increase, it indicates a higher demand for using the network.

Capital Flows

- Exchange Flows

Tracking inflows and outflows on exchanges can reveal investors’ intentions.

- Low net deposits on exchanges: according to CryptoQuant, net investments reported over the last 7 days are below the normal average, indicating a potential reduction in selling pressure.

- The increase in ETH reserves on exchanges may however signal a potential build-up in preparation for the time to sell.

- Flows to/from DeFi contracts

ETH locked up in decentralized finance (DeFi) is a sign of confidence in DeFi protocols. The growth of ETH stored in DeFi protocols indicates users’ perception of the usefulness of the ecosystem.

- Flows in staking contracts

Tracking ETH deposits for staking shows long-term investor confidence in the project. Massive deposits suggest increased commitment from participants and contribute to reducing the total available supply outstanding.

If you want to learn more about staking, we recommend the article “What is staking? A complete guide for beginners”

Whale Activity

Whales, investors holding significant amounts of ETH, are frequently monitored for their activity as their movements can signal major changes in sentiment or intentions.

Data provided today, April 8, 2025 by BlockchainReporter, indicates that one “whale” deposited $4.52 million and opened a long position in ETH with 20x leverage.

Network Staking

Another important indicator is the number of ETH coins blocked by staking. Staking not only gives investors confidence in the long-term development of the network, but also reduces the total supply available on the market, which can lead to a price increase.

- The total amount of ETH blocked by staking: Approximately 34.0 million ETH is staked, according to Coinbase.

- Percentage of total supply dedicated to staking: The percentage of total supply dedicated to staking provides an idea of investor engagement. Currently, 28.21% of circulating ETH is staked (Coinbase).

- Estimated annual reward rate: Investors who bet on staking can receive an APY reward of 2.09% per year.

ETH Price, where to?

Based on available data (April 8, 2025), Eth is showing stable activity with the potential for price growth in the immediate future. Although usage is below the long-term average, the lack of selling pressure on exchanges may be a positive signal for investors.

Eth price April 8, 2025: around 1565.7 USD (source Trading View)

ETH Price: Influencing Factors

Given that ETH is the second most popular cryptocurrency after Bitcoin, understanding the factors that influence the Ethereum price (ETH price) can help investors and companies predict market developments and make informed decisions.

Here are the main factors affecting the Ethereum price (ETH price)

Macroeconomic factors

Globaleconomic trends play a major role in determining investor behavior and the flow of capital into the crypto market.

Global financial policies

- Due to high interest rates and high inflation, market liquidity decreases, which negatively affects the allocation of capital to cryptocurrencies.

- Restrictive monetary policy (such as slowing central bank flows) may decrease the attractiveness of ETH.

- On the other hand, expansionary monetary policies, such as quantitative easing, favor investment in crypto assets.

Institutional adoption

- Investments by reputable financial institutions bring validation and certification to the Ethereum market.

- The use of ETH by businesses for payments or other processes is increasing demand at a rapid pace.

- Continued interest from institutions may improve the favorable outlook for the price of ETH. Firms such as Grayscale and Fidelity have added ETH to their portfolios, and continued institutional interest could bring significant liquidity to the market.

Regulations may have crucial effects on the value of Ethereum.

- Tighter restrictions may limit ETH trading, thereby decreasing the liquidity of the asset.

- Legal clarity on cryptocurrencies can give institutions confidence for adoption and investment.

- Staking decisions or smart contracts help shape the future of the network and price.

Fundamental factors underpinning the value of Ethereum (ETH)

Ethereum functions as a fundamental pillar for digital innovation in sectors such as DeFi, NFTs and smart contracts. The demand for ETH is directly proportional to the popularity of these technologies.

DeFi (Decentralized Finance)

As the main platform for DeFi protocols, Ethereum creates sustained demand for ETH. The Total Value Locked (TVL) in these applications is an indicator of popularity and can influence the ETH price.

NFTs (Non-Fungible Tokens)

Most transactions with NFTs are facilitated by the Ethereum blockchain. This constant use of the network claims a significant role in ETH deployment. However, a downturn in the NFT market may reduce transactions and demand for Ethereum.

Smart contracts

Smart contracts, used across multiple industries, highlight the versatility of the Ethereum platform. Increasing trade integrations and the emergence of new uses for smart contracts support Ethereum’s long-term prospects.

How do these factors influence the ETH price?

These factors actively influence the long-term direction of Ethereum in an increasingly competitive market. As the Ethereum blockchain continues to provide utility and innovation, investors and entrepreneurs need to watch market trends and on-chain indicators. Ultimately, the adoption of Ethereum as an infrastructure for applications and protocols plays a central role in enhancing its value and global use.

Ethereum forecast for 2025: ETH price at $6,700?

Forecasts for 2025 indicate a potentially significant price increase, with analysts estimating that Ethereum could reach $6,700 by the end of the year. But what supports this optimism? Let’s explore the key factors contributing to this forecast. What’s underpinning Ethereum (ETH Price) growth?

- SEC approval of Ethereum ETFs

In May 2024, the Securities and Exchange Commission (SEC) approved Ethereum ETFs. This marks an important milestone for streamlining institutional investment in ETH, with the potential to attract major capital flows. As ETFs offer investors an easier and safer way to invest in Ethereum without actually owning the cryptocurrency, this step could significantly boost demand and drive up the ETH price (ETH price).

- Layer 2 solutions

Another crucial factor for the future of Ethereum is the widespread adoption of Layer 2 solutions such as Optimism and Arbitrum. These innovations reduce transaction costs and improve the scalability of the Ethereum network. With lower transaction fees and a faster network, users are finding Ethereum more attractive, ensuring more usage of ETH coins.

- Pectra update from March 2025

The March 2025 update, known as Pectra, brings key enhancements to the user experience, such as simplifying smartcontracts and the ability to pay transaction fees with currencies other than ETH. This update will make Eth more competitive with other platforms and provide more flexibility for both users and developers.

- Integration with traditional finance

Ethereum is also gaining ground in traditional finance. Companies like State Street are working with Taurus to tokenize real assets on the Ethereum blockchain. This development opens new opportunities for Ethereum to become a key infrastructure in tokenizing financial assets and beyond. In the long-term, these collaborations contribute to more stability for both the network and the value of ETH.

- Increasing use in decentralized applications (dApps)

Additionally, Eth remains the undisputed leader in decentralized application development. From NFTs to smart contracts, the Ethereum blockchain has proven that Ethereum blockchain can support a wide range of revolutionary technologies. This trend will continue to expand the ecosystem and support growing demand for ETH cryptocurrency.

Which cryptocurrency to buy in 2025

In conclusion, Eth has significant potential to play a dominant role in the cryptocurrency market in 2025. If analysts’ forecasts are correct, the ETH price could reach the $6,700 threshold, offering investors significant gains.

While Ethereum’s prospects are extraordinarily promising, every investment comes with its own risks. The volatility of cryptocurrencies is well-known, and unforeseen events can significantly influence the market. If you want to invest in ETH, it is essential to constantly monitor industry news and make decisions based on up-to-date data.

Other articles of interest: