The house always wins. Launching ICOs and cryptocurrency listings.

What I’m getting across is that custodial exchanges that list new cryptocurrencies or meme coins always stand to gain. Substantial sums even.

Who’s storing the money? You or the cryptocurrency exchange?

In both cases, the money is in an account that you don’t control. The KYC (Know Your Customer) identification process is similar and is required to access your account. After filling it out, a dedicated account is created for you, and the available cryptocurrency wallet doesn’t give you full control because you don’t have the private key. For example if Binance decides to close your account tomorrow, you will have your account closed. Same if you store your cryptocurrency on Revolut.

A person who wants to withdraw $1,000 from Binance will notice that the transaction will first have the status “pending” until the platform approves it. This highlights the major control these exchanges exert over your funds.

Cryptocurrency user or user on a platform?

A sad reality is that cryptocurrency users actually become exchange platform users and not cryptocurrency users in the true sense of the word. Most enter the space for speculative reasons, not to trade goods or services.

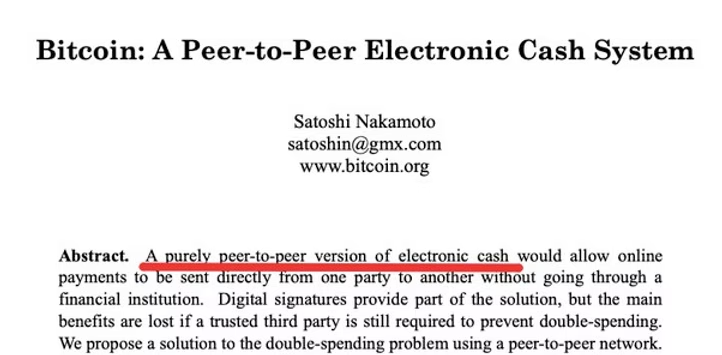

The intention of Satoshi Nakamoto, the creator of bitcoin, was to create a system that would be the new digital cash. A medium of exchange to replace the conventional system.

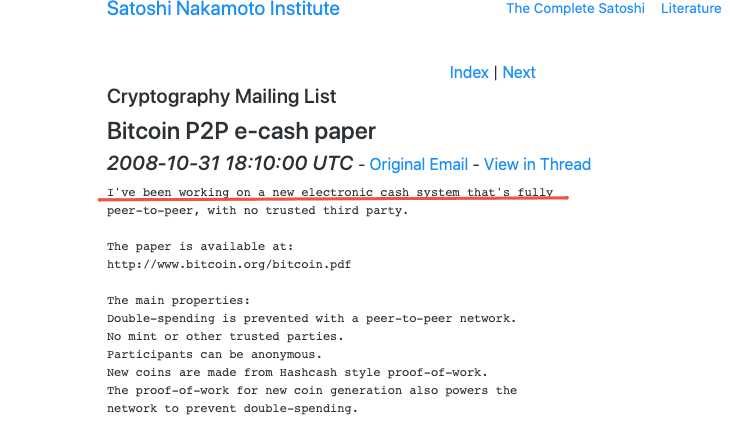

In an email he sent on 10/31/2008 he said:

So we can see that from the very beginning, the creator of BTC made this cryptocurrency to be used as a medium of exchange. Things have changed, custodial exchanges have come to power and they propose a different approach, they don’t say “use cryptocurrencies” they say “invest in cryptocurrencies”. Unfortunately, this model reduces the user experience in the cryptocurrency industry to simple logins and quick crypto-to-crypto or crypto- fiat conversions.

Everyone is talking about how they invested in cryptocurrencies, it’s almost impossible not to have in your group of friends “investors” who have invested in cryptocurrencies and follow cryptocurrency charts. Well many of these investors have no clue what a cryptocurrency is in the true sense of the word, have never made a cryptocurrency wallet, have never made any actual cryptocurrency transfer to purchase a service or product. They have watched charts, “courses that teach you to be a millionaire”, but they don’t actually know that the cryptocurrency has another purpose.

In the case of Bitcoin, the cryptocurrency was created to replace the current financial system, also nicknamed “digital cash” . This cryptocurrency was created to replace the old financial system, not to be purchased and put in the cupboard until its value reaches 1M USD. Attached below is the “Bitcoin White Paper” translated into Romanian. This document is the document that underpins Bitcoin and explains both its mission and the functionality that Satoshi Nakamoto gave to the cryptocurrency.

The impact of marketing on perception

The marketing of exchange platforms has profoundly influenced how we perceive cryptocurrencies. Today, discussions about crypto are dominated by “trading”, killing interest in actual use as payment methods.

This turns cryptocurrencies into speculative instruments. For example, by 2022, 65% of cryptocurrency users have completely ruled out using cryptocurrencies for payments, focusing instead on quick wins. This short-term strategy negatively affects the long-term viability and sustainability of the market.

Innovation stagnating

Innovation is key to the evolution of cryptocurrencies, but the monopolization of the market by a few custodial exchanges has led to stagnation. For example, according to a 2023 report, blockchain startups could experience a 25% drop in funds attracted due to the focus on large platforms.

Exchanges focus their resources to maximize trading revenue and commissions, ignoring the potential of innovation.You can’t find a POS in almost any store where you can pay with bitcoin, on product websites the same, users don’t want to trade their precious patterns that will make them rich. They have made an account on the platform, saved their password to the exchange and are waiting for the bull market

Speculative culture

The dominance of custodial exchanges has created a highly speculative culture. Most users enter these platforms with the aim of making a quick profit, which turns them into gambling instruments. If you’re looking for a newsroom that publishes news and you want to do a press article on cryptocurrencies, you will be placed in the “Bet” category .The internet is full of gurus who teach you how to make 10x 15x like the gentleman below, he knows how to make 15x but wants to be a good samaritan and help you, the less educated…

This mindset distorts the original values of cryptocurrencies. Start-ups and companies that develop real cryptocurrency adoption tools sit in the shadow of these giants that have monopolized the market, have led to deeply irresponsible behavior from which only they stand to gain.

The limitations of interacting with blockchain

The use of custodial exchanges limits user interaction with the blockchain. When funds are held on a centralized platform, users don’t benefit from the transparency and immutability offered by blockchain technology.

By using an exchange, users do not have the control they would have with a personal wallet. Users give up total control over their funds. The rise in theft through compromised private keys, which has resulted in losses of $2.2 billion, clearly demonstrates that ‘not your keys, not your crypto’ is not just an expression, but a harsh reality.

Attached below is the report conducted by TRMLABS on the year 2024, in which this data is evident.

User rights and user protection

User protection is a vital but frequently ignored aspect on exchange platforms. Users often do not benefit from additional safeguards. Some platforms claim to have insurances that in case of need will cover all losses, the amounts they say they can cover are enormous. But in reality, is this really going to happen? And if so, how long?

To improve security, it is essential that you store your funds yourself, you don’t have to store them on a platform whose addresses are well known and are always in the hackers’ sights. You can study the article “Hackers stole $1.5 billion.Bybit cryptocurrency heist” which shows the most recent heist in 2025 in which $1.5 billion was stolen from customer funds.To understand why the addresses of a custodial exchange are very well known, you when you deposit cryptocurrencies on a custodial exchange, you will receive an address on which to deposit cryptocurrencies, well that’s how hackers find out which addresses are associated with custodial exchanges. And because they are centralized entities, funds are often centralized…

But why if I buy bitcoins on Abarai, I don’t get the same thing? Because if you buy bitcoin on Abarai or if you sell bitcoin using Abarai, you are in control of your funds. You just tell us where to send cryptocurrency or we tell you where to send crypto, we don’t store your money for a moment. If Abarai gets hacked tomorrow, not a single customer will lose a single penny!

Reflections on the future of cryptocurrencies

Custodial exchanges such as Binance, Crypto.com and Coinbase have significantly affected the cryptocurrency market, turning it into a speculative environment.

To revive the original spirit of cryptocurrencies, a paradigm shift is needed. This could mean adopting non-custodial solutions, promoting companies that actually put their hands on real cryptocurrency adoption among users and businesses. User education is absolutely necessary otherwise we may find ourselves not getting rid of the n-n-thousands of cryptocurrencies that have appeared overnight that make no sense, famous meme coins like $Trump or $Melania

Serious efforts are needed to restore the true value of cryptocurrencies, the value that lies in the freedom and control they offer. It’s time to get back to honesty and rediscover what it really means to own and use cryptocurrencies!Learn what a wallet is, what a bitcoin wallet is. Try to understand what a blockchain is,